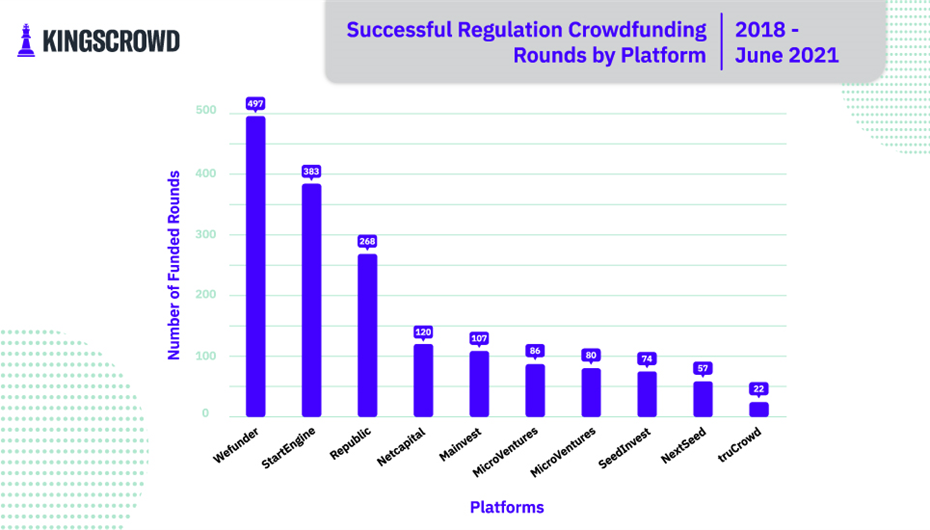

Why WeFunder, StartEngine and Republic have the most “successful” crowdfunding campaigns

Hello Beautiful People and in particular Founders. Today we’re going to discuss the obvious and the elusive of investment crowdfunding. The obvious things being why WeFunder, StartEngine and Republic have the most “successful” crowdfunding campaigns and then the elusive definition of “successful” when it comes to what that means to you as a Founder. You can read more about their success to date in this KingsCrowd article: https://kingscrowd.com/chart-of-the-week-which-platforms-have-most-successful-deals/

First some quick, obvious, maybe even a little dirty things that you should be aware of:

- It takes money to make money and even more to raise money.

- If you’re considering launching a “successful” crowdfunding campaign you should be planning to spend a minimum of 6 months and $150k planning, launching, and nurturing your “successful” campaign to success.

- Raised money isn’t earned. You’ve got to pay it back. So while your “successful” crowdfunding campaign is definitely some

Reg D - Turns out it still takes money to make money.

A bit ago I was on a webinar for Financial Poise, where I said that startups can expect to have a sunk cost of ~$46k in travel expenses alone and expect to take on average 21 months to raise money using the Reg D exception. On the webinar was “Mark”, the archetypical securities lawyer, who in typical lawyer fashion disagreed vehemently with these figures. So, what follows is a simple breakdown of typical expenses incurred in raising money via not only via Reg D but also JOBS ACT Reg CF and Reg A/A+ crowdfunding. Because it turns out that it still takes money to make money.

The Sunk Costs of Raising Capital

“A sunk cost is a cost that has already been incurred and cannot be recovered.”

There are numerous sunk costs in raising capital. For the entrepreneurs out there who will actually cut the checks here are the cold hard facts.

Reg D

Raising money via Reg D is the easiest and cheapest way to raise money if:

- You have an established business that is current

When it Comes to Investment Crowdfunding - Compliance Matters!

What to Know Before You Take the Plunge

The investment crowdfunding marketplace is growing faster than ever before, and is projected to grow by $196.36 billion from 2021 to 2025.

Unfortunately, industry watchers have observed an alarming level of non-compliance with the most basic rules of Regulation Crowdfunding by both companies raising capital and the platforms hosting the campaigns.

Non-compliance can result in regulatory enforcement action and/or investor lawsuits. So if you’re considering dipping a toe into the crowdfunding world, compliance should be at the top of your list.

In 2016, the SEC completed its rulemaking process for Regulation Crowdfunding. It suddenly became possible for a business to list an investment offering on a platform, and anyone in the United States could invest in the offering. But before doing that, the business, as well as the platform, must comply with some basic rules of the road.

According to a recent analysis, only a small minority ...more

Crowdfunding works best with Marketing

Crowdfunding doesn't actually raise you money, marketing does. Gotta market your deal.

Every Founder is looking for the same thing a) Customers b) "the right investor". You achieve both through marketing. Because at the end of the day its up to YOU to let the world know your business exist, what your vision for it is and how they're going to benefit from supporting you as either a customer, an investor or as an #Investomer.

To be clear, #crowdfunding doesn't HELP you raise money. It ENABLES you to raise capital from all levels of investors from VCs, Institutions, Angels and Retail Investors. It is still up YOU to market your deal, regardless of which type of investor you're looking for.

Hence another reason George Pullen and I are so pumped about GoingPublic.com as it is a marketing (and Distribution) engine for startups.

So, if you want to increase your odds of success for your funding campaign (RegCF, RegA or RegD) remember to be ready to tell your story and market your ass off...more

What is the best place to launch a crowdinvesting product?

Question from Aaron:

Happy Sunday Samson! I’m definitely enjoying and appreciating all your posts and article on the power of crowdfunding and crowdinvesting to help gain market share and loyal customers for the long haul. I had a question about the best place to launch a crowdinvesting product on a platform to gain the most views from future customers/investors, as I’ve been working on a project for the last year that revolves community development. I’d love to get your feedback and opinions on this at your best convenience if would be that great of a human! Thanks and happy Sunday! 😊

Answer from Samson

TODAYSamson Williams sent the following message at 8:52 AMView Samson’s profile Samson Williams 8:52 AM

Morning Aaron!

You have 3 options:

- Book time on my calendar so for $500 an hour an I explain why it doesn't matter which platform you select here: https://www.milkywayeconomy.com/schedule-a-call

- Just take my word for it.

- Stop believing platform

What are startup's options for securing $50k - $5M in financing?

Generally it is assumed that the options for startups and businesses to pursue financing are as follows:

- Option A - VCs

- Option B - Angels

- Option C - Broker Dealers / PE / Hedge Funds

- Option D - Crowdfunding

In truth the options are:

- Option A - Crowdfunding / Angels / VCs / BDs / PE/ Hedge Funds

- Option B - Bootstrap then crowdfund

The reason that Crowdfunding is every startup’s first option is simple:

- Crowdfunding enables Founders to set investment terms

- With these universal crowdfunding terms, Founders can solicit investments from investors at all levels (accredited, non-accredited, institutional)

- Currently, Founders and Entrepreneurs exhaust themselves pitching to ONLY 4% of the accredited investor population; which is well known to have a 99% failure rate.

- Less than 1% of Startups receive VC funding.

- Crowdfunding enables Founders and Entrepreneurs to take the same pitch deck, due diligence, financials and disclosures and literally cast a wider net

The top 5 reasons every Founder should be crowdfunding.

By Samson Williams

TL;DR

- Investment crowdfunding enables you to set terms on your terms

- 60% of investors in crowdfunding campaign are already accredited

- Crowdfunding platforms make managing your cap-table and communicating to investors easier

- Increase in sales revenue while running your investment crowdfunding campaign

- Increase in the lifetime value of your customers, as Investomers

Any discussion about raising money should start off with the obvious. Raising money is hard AF and sucks. Too, there is no guaranteed way to raise capital for your business or startup. That said, if you are considering offering your Startup baby to Sharks for capital, here are a few things you should know about why Investment Crowdfunding should be your first option.

1. Setting The Terms

So, you are looking to raise capital? But on whose terms? Yours? Or Sharks? The primary benefit of crowdfunding is that i...more

Founders > Funding Platform Brand

“Silicon Prairie is pushing the industry so that it is less about whose platform you use (because investors will go directly to the Founder’s “own” website) and more about the Founders/Issuers themselves. Which means, CF portals are headed to the plumbing side of things, a la Internet Service Provider (“ISP”). No one cares who your ISP is and no one will care who provides their funding portal’s plumbing.” Samson Williams, internal email on Silicon Prairie’s new “private portal” offering.

Investment Crowdfunding turned 5 years old in May 2021. Why do you care about what this VC killing kindergartener is up to? Simple, the ability for Founders to raise up to $5M via RegCF is changing the culture, perception and reality of venture investing. How? This article will shed light on how and why this matters to you as a Founder, an Investor and more importantly as an Investomer.

Founders are the Future of Funding

Investment Crowdfunding is “new”. As such the...more