- Home

- Q&A

-

Why are the SEC and FINRA rules around crowdfunding advertising so damn stupid?

It’s a fair question - and one that nearly every founder, issuer, and portal marketer has asked at some point. The truth is, the rules aren’t stupid so much as stuck in another era. They were written before social media, analytics dashboards, or API-based ad targeting even existed, and they’ve never... more

It’s a fair question - and one that nearly every founder, issuer, and portal marketer has asked at some point. The truth is, the rules aren’t stupid so much as stuck in another era. They were written before social media, analytics dashboards, or API-based ad targeting even existed, and they’ve never caught up with the way modern marketing actually works.

Under Regulation Crowdfunding (Reg CF), almost any public communication that even hints at a live investment opportunity is treated as solicitation. The SEC’s framework requires that offering-related messaging be limited to “tombstone-style” notices - factual, stripped of persuasion, and always directing readers back to the funding portal where the full disclosures live.

Why? Because the system is designed to prevent selective solicitation - the idea that someone could cherry-pick who sees an offering, giving certain investors an informational advantage. Regulators want everyone to have the same disclosures, at the same time, in the same place. On paper, that protects fairness and transparency. In practice, it makes every modern marketer feel like they’re working under rules written for the fax-machine era.

The irony is that today’s digital tools could make crowdfunding more transparent, measurable, and accountable - if only the rules allowed sensible use of them. Instead, compliance officers and ad managers spend their lives parsing whether a headline, emoji, or URL parameter “conditions the market.” It’s exhausting, expensive, and, yes, it feels damn stupid.

The hopeful news: the Crowdfunding Professional Association (CfPA) and other policy advocates are pressing the SEC to modernize these rules - to recognize that responsible data-driven marketing can coexist with investor protection. Until that happens, issuers and portals are left threading every campaign through a regulatory needle that was forged in the 1930s and polished once more in 2015.

less -

Am I allowed to invest as much as I want in a company that is crowdfunding? Am I allowed to invest as much as I want in a company that is crowdfunding?

Under Regulation Crowdfunding, how much you can invest depends on whether you are an accredited or non-accredited investor.

Accredited Investors

Accredited investors are not subject to investment limits under Reg CF.

If you meet the SEC’s accredited investor criteria - such as high income, high net wo... more- Consultants

-

What are some of the best marketing techniques that you’ve seen used for crowdfunding campaigns?

The key lesson I've learned over the past decade in the industry is that your campaign needs a marketing budget. I believe that with rare exceptions, a successful campaign needs a marketing budget equivalent to at least 10% of the total raise. One-third to half of that will need to be spent relative... more

The key lesson I've learned over the past decade in the industry is that your campaign needs a marketing budget. I believe that with rare exceptions, a successful campaign needs a marketing budget equivalent to at least 10% of the total raise. One-third to half of that will need to be spent relatively early in the campaign.

Given this requirement, it is important to price your offering in such a way that you factor this in upfront.

less -

Commissioner Atkins recently made the following speech. "American Leadership in the Digital Finance Revolution" https://www.sec.gov/newsroom/speeches-statements/atkins-digital-finance-revolution-073125 How could this affect Regulation Crowdfunding?

If the SEC follows through on the vision in this speech, it could have major knock-on effects for Regulation Crowdfunding (Reg CF) in several ways—particularly if crypto assets and tokenization become integrated into mainstream U.S. securities markets.

Here’s the likely impact broken down:

1. Tokeni... more

If the SEC follows through on the vision in this speech, it could have major knock-on effects for Regulation Crowdfunding (Reg CF) in several ways—particularly if crypto assets and tokenization become integrated into mainstream U.S. securities markets.

Here’s the likely impact broken down:

1. Tokenized Securities Could Become Reg CF Norm

Current situation: Reg CF offerings are mostly traditional equity, debt, or SAFE instruments. Tokenized securities are rare due to unclear SEC guidance, high compliance costs, and custody/trading constraints.

Speech effect: If “Project Crypto” delivers clear, purpose-fit disclosure rules and exemptions for tokenized securities—and allows them to trade on-chain—issuers could easily offer tokenized shares or revenue-sharing tokens under Reg CF.Impact:

- Faster, cheaper secondary trading of Reg CF securities.

- Greater retail investor appeal due to liquidity potential.

- Easier fractionalization of ownership, making micro-investments practical.

2. Clear Rules for Crypto Asset Securities Could Expand Issuer Types

Current situation: Blockchain startups often avoid Reg CF because of uncertainty over whether their token is a security and fear of future enforcement.

Speech effect: Bright-line rules for classifying crypto assets (security vs. commodity vs. collectible) could let Web3 and DeFi projects confidently raise capital under Reg CF without complex offshore structures.Impact:

- Surge in crypto-native Reg CF campaigns.

- Potential for hybrid offerings (token + equity).

- More investor protections built in through token standards like ERC-3643.

3. Custody Rule Changes Could Enable Crypto Asset Holding in Reg CF

Current situation: Custody of digital securities for Reg CF investors is cumbersome—few broker-dealers or funding portals can handle them directly.

Speech effect: If custody rules are modernized to allow self-custody or broader custodian choice, Reg CF investors could hold their securities in personal wallets or use a wide range of regulated custodians.Impact:

- Lower custodial friction.

- Reduced reliance on illiquid, portal-controlled transfer agents.

- Investor empowerment and portability.

4. Secondary Market Liquidity Could Dramatically Improve

Current situation: Reg CF securities can be sold after 12 months (with exceptions), but active markets are minimal due to low adoption of ATSs and high compliance burdens.

Speech effect:“Super-app” licensing could allow a single platform to handle both primary Reg CF offerings and secondary trading (tokenized and traditional).

On-chain trading systems could operate without traditional intermediaries.Impact:

- More vibrant secondary markets for Reg CF securities.

- Potential for real-time settlement and 24/7 trading.

5. Innovation Exemption Could Lower Barriers for New Reg CF Models

Current situation: New funding portal business models must fit into rigid, pre-defined rules or go through lengthy exemptive relief processes.

Speech effect: An “innovation exemption” could allow experimental Reg CF structures—like DAO-managed investment clubs or community-governed funding pools—to launch quickly with lighter, principles-based oversight.Impact:

- Faster rollout of creative crowdfunding models.

- More niche, community-driven funding portals.

- Potential for cross-border investment flows into U.S. Reg CF deals.

6. Competition With Offshore Platforms Could Shift

Current situation: Offshore token-based capital raises often bypass U.S. retail investors.

Speech effect: By giving crypto and token issuers a clear, efficient domestic path—including under Reg CF—those offerings could shift onshore.Impact:

- U.S. Reg CF platforms could win back issuers who previously went abroad.

- Stronger global competitiveness of U.S.-based portals.

Bottom Line

If implemented, “Project Crypto” could transform Reg CF from a mostly equity/debt crowdfunding market into a fast, on-chain, liquid ecosystem—blurring lines between private and public markets.The biggest winners would be:

- Issuers seeking low-cost, retail-friendly capital with built-in liquidity.

- Funding portals that adapt quickly to on-chain custody, tokenization, and integrated trading.

- Retail investors who gain faster exit opportunities and broader asset choice.The key dependencies will be:

- How quickly the SEC finalizes “purpose-fit” Reg CF tokenization rules.

less

- Whether secondary trading exemptions are expanded.

- How the “innovation exemption” is scoped for funding portals.

1 -

Is my company a fit for investment crowdfunding? Is my company a fit for investment crowdfunding?

Good question. No one can answer this question with certainty -- but there are some attributes that could help make your company a good fit.

First, if your company has a compelling story, a clear growth plan, and a product or mission that everyday people can understand or get excited about, then yes... more

- Consultants

-

Is the TRUMP Jobs Act the same as the 2017 Tax Cuts and Jobs Act or its extension? Is the TRUMP Jobs Act the same as the 2017 Tax Cuts and Jobs Act or its extension?

No. The TRUMP Jobs Act is a completely different proposal - and a far better one. It’s focused on powering small business growth and local job creation, not reinforcing the failed trickle-down policies of the past.

Here’s how they differ:

The TRUMP Jobs Act:

Backed by the Coalition for Crowdfunding A... more- Unclassified

-

How could SEC Commissioner Peirce's sketch of an idea for a potential exemption from registration to allow firms to use DLT to issue, trade, and settle securities potentially impact regulated investment crowdfunding?

SEC Commissioner Hester Peirce’s sketch of a potential exemption from registration to allow firms to use distributed ledger technology (DLT) to issue, trade, and settle securities could have significant implications—both positive and disruptive—for regulated investment crowdfunding (Reg CF). Here's ... more

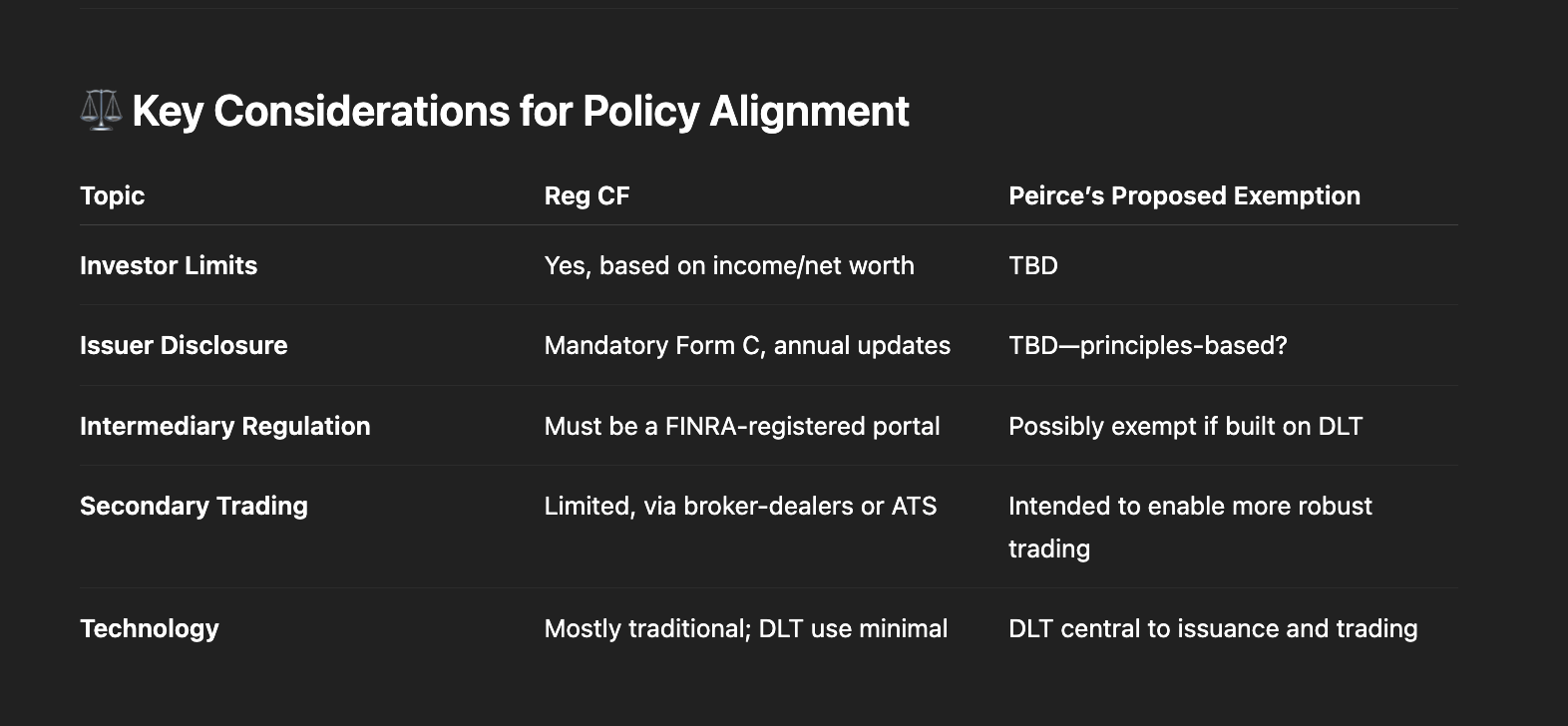

SEC Commissioner Hester Peirce’s sketch of a potential exemption from registration to allow firms to use distributed ledger technology (DLT) to issue, trade, and settle securities could have significant implications—both positive and disruptive—for regulated investment crowdfunding (Reg CF). Here's a breakdown of the potential impacts:

🔍 How the DLT Exemption Could Affect Reg CF1. Creates a Competing Capital Formation Pathway

If the exemption enables issuers to raise capital and trade tokenized securities more flexibly than under Reg CF, it could:- Draw issuers away from Reg CF, especially those seeking lower compliance burdens or faster execution

- Undermine the utility of funding portals that have invested in compliance infrastructure under Reg CF/Reg A

2. Erodes Investor Protections If Not Carefully Calibrated

Reg CF includes robust investor caps, disclosures, and portal oversight:

- If DLT-based exempt offerings don't include equivalent protections, retail investors may be exposed to higher risks without adequate guardrails.

- This could weaken confidence in retail-facing investment markets broadly

3. Undermines Level Playing Field for Intermediaries

Funding portals must:

- Register with the SEC and FINRA

- Implement anti-fraud procedures

- Adhere to strict communication guidelinesIf a DLT-based venue is exempt from similar obligations, it may function like a funding portal or ATS without having to comply with equivalent rules—creating an unfair regulatory asymmetry

4. Tokenization Could Be a Tool—Not a Threat—If Integrated

If the exemption framework evolves to support tokenized Reg CF securities, it could:

- Enable faster settlement and secondary liquidity for crowdfunding investors

- Enhance investor engagement through programmable assets, wallet integration, and smart contracts

- Lower custody costs and improve capital stack transparency

🧭 Strategic Implications for the Regulated Crowdfunding Industry

If Not Integrated:

- Funding portals may lose deal flow to lightly regulated DLT venues

- Investor confusion could rise as new platforms emerge without clear SEC/FINRA alignment

- Reg CF infrastructure could be marginalized, despite years of ecosystem-building

If Proactively Integrated:

- Portals that embrace DLT for post-issuance management or settlement could lead innovation

- Reg CF rules could evolve to explicitly allow for tokenized securities, with safe harbor language

- SEC could require exempt DLT platforms that target retail to meet Reg CF-like protections

✅ Recommendations for Industry Stakeholders and Policymakers1. Advocate for Harmonization:

Ensure any DLT exemption includes equivalent investor protection standards as Reg CF.

2. Push for Tokenized Reg CF Pathways:

Encourage the SEC to issue guidance or no-action relief for DLT use within Reg CF, especially around custodial tokens, secondary transfers, and smart contract-based compliance.

3. Monitor Market Fragmentation Risk:

Prevent two-tier markets—one regulated (Reg CF), one not—by ensuring oversight parity.

4. Participate in Public Comment:

As the SEC considers exemptive relief, funding portals, investor advocates, and Reg CF issuers should engage directly with the Crypto Task Force’s process.

🔗 In SummaryPeirce’s DLT exemption sketch is forward-looking and pro-innovation—but it may unintentionally disrupt the fragile progress of regulated crowdfunding unless protections and standards are aligned. The future could be synergistic, but only with clear boundaries and deliberate coordination.

Note: Commissioner Peirce's thoughts are outlined here: https://www.sec.gov/newsroom/speeches-statements/peirce-iismgd-050825

less -

Can you comment on Paul S. Atkins Sworn In as SEC Chairman based on the SEC Press Release and from the perspective of the crowdfunding industry? https://www.sec.gov/newsroom/press-releases/2025-68

From the perspective of the regulated investment crowdfunding (Reg CF and Reg A) industry, the appointment of Paul S. Atkins as SEC Chairman raises both opportunities and questions.

🔎 Perspective from the Crowdfunding Industry:

1. Pro-Market, Pro-Business Philosophy Could Mean Support for Capital F... more

From the perspective of the regulated investment crowdfunding (Reg CF and Reg A) industry, the appointment of Paul S. Atkins as SEC Chairman raises both opportunities and questions.

🔎 Perspective from the Crowdfunding Industry:

1. Pro-Market, Pro-Business Philosophy Could Mean Support for Capital Formation. Chairman Atkins has long championed capital formation and reduced regulatory burden, particularly through cost-benefit analysis. This mindset aligns well with the goals of the crowdfunding sector, which seeks to democratize capital access for startups and small businesses. His background suggests he may be open to expanding access to capital for both issuers and investors through mechanisms like Reg CF and Reg A+.

2. Track Record of Favoring Innovation—Positive for Fintech and Digital Asset Integration

Atkins’ role in developing best practices for the digital asset sector suggests he’s not afraid to engage with new technologies.

This could bode well for:

- Tokenized securities

- Blockchain-based cap tables

- Smart contract-based compliance —all areas that the crowdfunding industry is beginning to explore.3. Potential for Regulatory Rollbacks or Modernization

Atkins has previously pushed for greater consistency and simplification in regulation. That could open the door to:

- Raising Reg CF investment and offering limits

- Reducing duplicative state filing burdens

- Streamlining ongoing disclosure requirements

- Allowing more flexible use of SPVs and follow-on offerings4. Investor Protection vs. Market Access

However, Atkins' emphasis on cost-benefit analysis and industry flexibility may worry some investor advocates who want stronger safeguards in crowdfunding. There is a delicate balance here. The crowdfunding industry—especially responsible funding portals and associations like CfPA—will need to proactively demonstrate that investor protection and market growth can co-exist.

5. A Chance for Dialogue

Given his extensive experience across SEC leadership roles and international regulatory forums, Atkins is likely to be receptive to policy engagement. This is a valuable opening for the crowdfunding industry to:

- Push for rule modernization

- Advocate for new exemptions or refinements

- Collaborate on digital compliance infrastructure

📣 Final Thought:The appointment of Paul S. Atkins could signal a more business-friendly, innovation-minded SEC. The crowdfunding industry should engage early and often, presenting data, success stories, and constructive proposals to shape a regulatory environment that protects investors without stifling innovation. If navigated well, this could be a turning point for scaling regulated crowdfunding in the U.S. capital markets.

#regulatedinvestmentcrowdfunding

less2 -

If a company files more than one Fprm C- do they need to file a c-at for each raise or just one for the entire year?

A Form C-AR relates to a company, not to a particular raise. You file one C-AR regardless of how many offerings you did.

3