SuperCrowd22: Generational Trends in Impact Investing

I'll be presenting on Thursday some really interesting stats on how millennials are the driving force for Impact Investing.

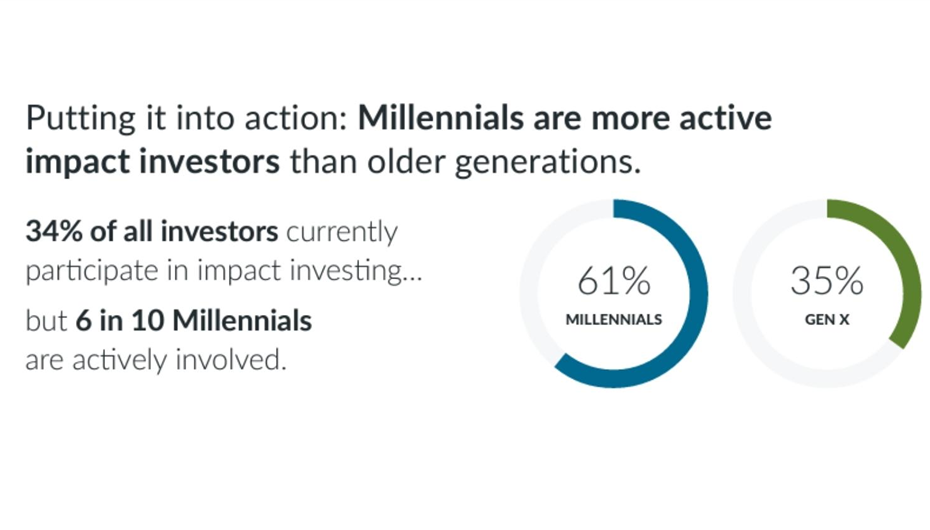

A new study from Fidelity Charitable shows how millennials are leading the way in participating in impact investing, as it’s an effective avenue to align their values with their financial choices. For them, impact investing is just as much pride of ownership as it is about influencing positive change.

Some of their key findings:

- Millennials will continue driving the adoption of impact investing as they come to control more wealth. Already, 61% are utilizing values-based investing strategies

- In addition to the personal fulfillment that comes from aligning their investments with their values, 62% of Millennials believe that impact investing has greater potential than traditional forms of philanthropy to create long-term positive change.

- Values-based investing is beginning to catch on more broadly. While only 1/3 of all investors engage in impact investing cur

SuperCrowd22: Will Local News be the Next Frontier for Investment Crowdfunding?

Tomorrow I will speak at SuperCrowd22 (see: https://www.supercrowd22.com ) - a two day event (September 15/16) - along with thought leaders and practitioners addressing issues at the cross section of impact investing + investment crowdfunding.

I am honored to be participating in this event.

I'll address the topic of "Will Local News be the Next Frontier for Investment Crowdfunding?"

I believe it's a topic of vital importance to our country and for the preservation of US democracy. At SuperCrowd, I'll speak to: 1) the current state of Local News media (it's not good) 2) a historical perspective on how we've gotten here and 3) a view on what can be done to help save or reinvigorate Local News across the country.

As a preview, here are some slides and facts from part one of my presentation - the current state of Local News.

Slide 2: The US loses two local newspapers each week! Since 2004, there has been a net loss of 2,514 papers.

...more

Crowdfunding Inflation

Big news from the SEC: inflation.

Crowdfunding rules are full of limits that are adjusted by the SEC under authority from the 2012 JOBS Act.

Here's the latest: https://www.thecorporatecounsel.net/blog/2022/09/jobs-act-inflation-adjustments-finally-arrive.html

...more2021 CfPA Chairman's year-end address

Friday, December 31, 2021

Dear friends,

Thank you for another year far surpassing my hopes both personally and professionally.

The CfPA continues to be highly-regarded here and abroad as a generous and vital organization expanding access to capital and opportunity for entrepreneurs, small businesses and investors. Our work in 2021 helped Crowdfunding reach new highs, extended our global voice, and expanded our capacity domestically. We saw over $500M raised using RegCF offerings where even non-accredited investors finally got a piece of the pie. We saw RegA+ offerings land over $2B. For these, and so many other reasons, it continues to be an honor to be a part of a leadership team on the cutting edge of Alternative Finance. CfPA’s reputation continues to be enhanced by the many professionals who freely contribute their time and expertise to advancing the association and the industry. There have been so many noteworthy moments and I look forward to seeing even more debut in ’22.

In 2021...more

2019 CfPA Chairman's public address

Sunday, January 13, 2019

Dear friends,

A vast majority of you reading this letter are part of the Crowdfunding community—whether you know this yet or not, your knowledge, initiative, collaboration...and pocketbook have made our industry touch more lives than you might imagine. We at the Crowdfunding Professional Association thank you for all your imagination, hard work and follow-through, and celebrate with you the continued growth enjoyed by communities everywhere. I want to preface this letter by making certain my fellow volunteers at the CfPA are aware just how fortunate we are to have their gift of time, knowledge and leadership—thank you, again.

At its simplest, Crowdfunding lives at the intersection of crowdsourcing and alternative finance, and even until recently was seen more as a funding method for ventures too risky for conventional capital or for entrepreneurs lacking loan-worthy collateral or relevant experience. But in just six+ years since passage of the JOBS Act, Crowdfu...more

2018 CfPA Chairman's year-end address

Wednesday, January 9, 2019

Dear members, friends and colleagues,

Unlike students “getting back to school” each fall, the best work of our association’s many volunteers tends to commence at the start of each new calendar following a frenetic year-end rush both professionally and personally. So, welcome back—I hope your 2018 was prosperous, and your holiday break inspirational and renewing.

Before outlining our goals for 2019, I need to first thank and congratulate all for a pivotal year that commenced with the necessary and successful recruitment of what many have confessed to me is an enviable assembly of alternative finance pioneers and thought leaders—over 34 remarkably generous board members, advisors and committee members, tripling all previous leadership. I am humbled to have gained your mindshare and commitment toward pursuing the CfPA’s noble mission. However, I emphasize “toward” because, as an organization, our ultimate fulfillment remains just over the horizon—we have much to...more

3 Ways to Get Cheap Tickets, 10 Good Reasons to Attend and 5 Bad Reasons Not to Join SuperCrowd22

3 Ways to Get Cheap Tickets to SuperCrowd22

Let’s get this out of the way quickly. There are three ways to get cheap tickets to SuperCrowd22.

- Save $100 here. Everyone is eligible.

- Pay what you can here. If you can’t afford the full price or even half price, pay what you can. No questions asked. We don’t want the cost to keep you from attending.

- Become a CfPA Member. You can join for just $10 per month and cancel at any time. We hope you’ll stay for a long time. Benefits include free or discounted admission to future events. Members can purchase tickets to SuperCrowd22 for just $75%

Register for SuperCrowd22!

10 Good Reasons to Attend SuperCrowd22

There are countless good reasons to join us for SuperCrowd22; here are just ten:

- Meet people like you. Every day you get up determined to make the world a little better. Wouldn’t it be great to increase your circle of friends who do the same thing!

- Learn from experts. The roster of speakers is nearly 100 people long, including the smar

NFTs: What constitutes a bubble bursting?

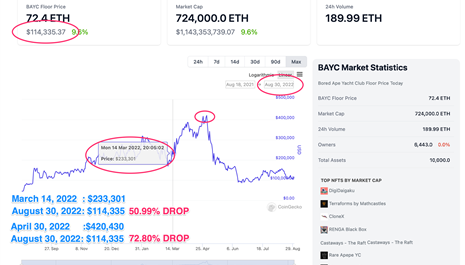

On March 14, 2022 I wrote about putting a 4k Bored Ape Yacht Club NFT up for sale (all proceeds to charity) on OpenSea to point out structural deficiencies in "NFTs 1.0" and concluded that it was "exhibit #1 that these 'digital art' NFTs represent a bubble about to burst." (Note: It didn't sell) https://crowdfundingecosystem.com/kb/article/psychedelic-safari-bored-ape-nft-for-sale-proceeds-to-charity

On that day, the floor trading price of a BAYC NFT was $233,301. The bubble continued to inflate for another six weeks until April 30 when it reached $420,430. But as of this writing, August 30, it's down to $114,335 which is a 50.99% DROP from my March 14th posting and a 72.80% drop from the peak.

Now for Exhibit B: NFT trading on OpenSea is crashing. See: "Trading volume on top NFT marketplace OpenSea down 99% since May" https://fortune.com/2022/08/29/nfts-opensea-crypto-winter-bubble-blockchain-web3

It appears all those OpenSea wash traders are spending the summer months w...more

Devin Thorpe

Devin Thorpe