SEC Commissioner Hester M. Peirce to speak at CfPA Summit

|

CfPA Regulated Investment Crowdfunding and Leadership Summit 2024 - Detailed Agenda

Day 1 (10/22: Tues.) : Advocacy Visits & Pre-event Reception

|

10:00 AM - 5:30 Advocacy Meetings

|

Capitol Hill + Regulator visits CfPA members registered for the Summit may be eligible to attend some of the advocacy meetings. |

|

5:30-8:00 PM Cocktail Reception |

Sunset Cocktail Reception Top of the Town - Top Floor and Rooftop (1400 14th Street North, Arlington, VA) (Streaming Music by DJ Scott McIntyre)

|

Day 2 (10/23: Wed.) : Conference and Summit

Venue: Top of the Town (Top Floor 1400 14th Street North, Arlington, VA)

“One of the most magnificent views in Washington”

...more

Unlocking Community Support for Climate Tech Infrastructure Projects Through Regulated Investment Crowdfunding and Lessons of Community Ownership from Germany and Denmark

Infrastructure development in the United States, particularly in climate tech sectors like wind farms, solar plants, waste-to-energy facilities, or other First of a Kind (FOAK) projects, frequently faces substantial local opposition. This resistance, commonly referred to as "Not In My Backyard" (NIMBY), is driven by concerns over environmental impact, property values, and disruptions to daily life. The resulting delays not only stall project timelines but also threaten the U.S.'s ability to meet crucial climate goals. Slowing the growth of renewable energy projects undermines efforts to reduce carbon emissions and transition to a sustainable energy system.

However, countries like Germany and Denmark have demonstrated an effective solution: community ownership. By allowing local residents to invest directly in infrastructure projects, these nations have transformed NIMBY-driven opposition into widespread support. In the U.S., regulated investment crowdfunding (Reg CF and Reg A) presents...more

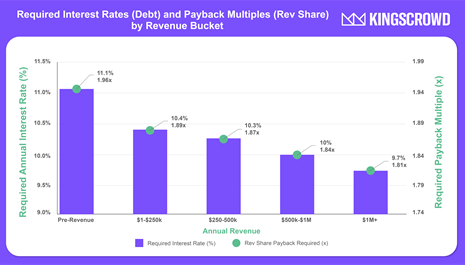

Are Current Debt and Revenue-Share Interest Rates Fair for Investors?

While many investors typically feel that debt deals are “lower-risk” than equity deals in investment crowdfunding, I’ve always wondered if that’s really the case. As investors, we have plenty of options for where to put our money — like zero-risk savings accounts at banks currently offering 4.6% or even 5% interest! So, I decided to dig into the data on debt and revenue-share offerings to see if the interest rates are actually compensating investors for the risks they’re taking.

Required annual interest rates and payback multiples over 6.4 years for investors holding a diversified portfolio of debt and revenue-share Reg CF deals to break-even after accounting for failures and risks.

...moreTLDR: to adequately compensate Reg CF investors for risk and opportunity costs, we estimate that the current average debt interest rate should be roughly 11.1% on pre-revenue deals and 10.2% on post-revenue deals. For revenue share notes, the break-even payback mu

[CfPA Press Release] CfPA Announces Board Approval of Policy Platform

Industry trade group representing the Regulated Investment Crowdfunding industry releases major policy platform with recommendations for change

Washington, DC (May 20, 2024) - The Crowdfunding Professional Association (CfPA), the leading trade group representing the Regulated Investment Crowdfunding industry, announced the board's approval of a Policy Platform containing eighteen recommendations for the industry. Through these recommendations, the CfPA intends to advance the fledgling industry, which has enabled over 6,500 companies to raise more than $2.4 billion from millions of non-accredited investors in the eight years since the industry's rules came into effect.

"The CfPA Policy Platform represents the concerns and interests of a wide range of stakeholders in the Regulated Investment Crowdfunding industry," stated Brian Christie, the 2024 President of the CfPA. “Broad adoption of the platform’s recommendations by industry participants, regulators, and lawmakers...more

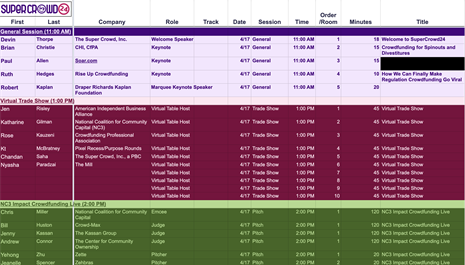

Grateful for the super people at SuperCrowd24

On behalf of the Crowdfunding Professional Association (CfPA), I would like to express gratitude to @Devin Thorpe and @Chandan Saha for providing CfPA with the opportunity to co-host SuperCrowd24 and for giving the CfPA board and members the opportunity to share their perspectives and expertise and to connect with a community of attendees from all over the world. The event was highly engaging and informative (-- and provided a welcome diversion following the end of this year’s tax season).

The agenda was packed, the speakers were amazing, and the topics were relevant across a wide range of themes. Personally, I was pleased to hear numerous discussions about the possible integration of regulated investment crowdfunding into the full capital stack of various businesses -- from small enterprises seeking SBA loans to major corporations managing complex divestitures – as it points to a future where crowdfunding and community-ownership could be an important pro-social subs...more

Dive into the World of Crowdfunding Excellence with SuperCrowdHour February 2024!

Attention all crowdfunding enthusiasts and aspiring changemakers! The highly anticipated SuperCrowdHour event for February 2024 is just around the corner, and we couldn't be more thrilled to welcome you!

Countdown Begins: With the event date fast approaching, mark your calendars for February 21, 2024, at 1:00 PM Eastern. Get ready to dive deep into the world of crowdfunding excellence!

https://www.youtube.com/watch?list=TLGGSFSdz8WDyigxODAyMjAyNA&v=HoQyB5CFHLA

Meet the CFPA Leaders: Join us as we host the esteemed Crowdfunding Professional Association (CFPA) leaders:

- Brian Christie, CFPA President

- Jenny Kassan, CFPA Vice President

- Brian Belley, CFPA Secretary

- Scott McIntyre, CFPA Chair

What to Expect: Gain exclusive insights, connect with industry experts, and learn how you can make a difference in the crowdfunding community. SuperCrowdHour is your gateway to unlocking new opportunities and achieving crowdfunding success!

Special Incentive: Remember, attendees who register for an...more

Get Ready for SuperCrowd24 - The Ultimate Virtual Crowdfunding Experience!

We hope this message finds you well and thriving! We are thrilled to bring you the latest update on an event that promises to revolutionize your understanding of crowdfunding and investment – introducing SuperCrowd24!

📅 Save the Date: April 17-18

📍 Location: Your Screen - It's a Virtual Event!

Get ready for an immersive experience at the impact crowdfunding event of the year! SuperCrowd24 is designed to connect investors, entrepreneurs, and enthusiasts from around the world, all from the comfort of your home.

What to Expect: ✨ 100 Expert Speakers: Learn from the best in the business as 100 industry leaders share their insights and strategies for successful crowdfunding and investment.

🎙️ Live Pitch Sessions: Witness entrepreneurs pitch their groundbreaking ideas in real-time! Who knows, you might discover the next big thing to add to your portfolio.

💡 Learn to Invest Like a Pro: Whether you're a seasoned investor or just starting, SuperCrowd24 offers valuable tips and techniques ...more

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

Crowdfund Holdings Innovators (CHI)

Crowdfund Holdings Innovators (CHI)