CfPA Regulated Investment Crowdfunding and Leadership Summit 2024 - Detailed Agenda

Day 1 (10/22: Tues.) : Advocacy Visits & Pre-event Reception

|

10:00 AM - 5:30 Advocacy Meetings

|

Capitol Hill + Regulator visits CfPA members registered for the Summit may be eligible to attend some of the advocacy meetings. |

|

5:30-8:00 PM Cocktail Reception |

Sunset Cocktail Reception Top of the Town - Top Floor and Rooftop (1400 14th Street North, Arlington, VA) (Streaming Music by DJ Scott McIntyre)

|

Day 2 (10/23: Wed.) : Conference and Summit

Venue: Top of the Town (Top Floor 1400 14th Street North, Arlington, VA)

“One of the most magnificent views in Washington”

...more

How funding portals can reduce CAC & CIC:

Posted at 8/14/2023

Cost of Investor Acquistion

Creating institutional capital investment pools with funding portals is hugely important. Honeycomb Credit has trailblazed that with a foundation. You can go to pension funds, banks, insurance companies, credit unions, etc with these kinds of proposals. Point to HoneyComb's success story, differentiate your portal.

Side-note: would love to start seeing partnerships between niche portals.

If you aren't ready to do that yet, and are starting off with founders in your direct network, I would fill your relevant social media channels (that you send to people) with accessible and engaging demos of your product from the investor's perspective. Of course, content for business owners is important too... but think about it this way: fundraising businesses will be sending your social media content to their investors as to explain how the process is going to go.

Educational content on why your niche and portal serve a critical need. Explain to investors, why their investm...more

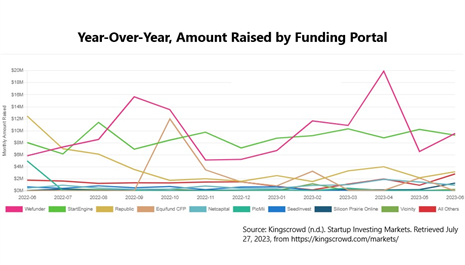

Our industry is broke

Dear colleagues at Crowdfunding Professional Association and beyond. We all love saying that the industry is doing great.

Math says "that's bs; CF industry is broke and dealflow is the problem." I am using funding portal data because transparency is forced upon these intermediaries.

Please don't shoot the messenger. I would like to be proven otherwise.

There are 70,000 startups in the United States within 33,000,000 small businesses. How many active Regulation Crowdfunding deals are there right now? 450.

Let's say that the average salary for a portal employee is $75,000 ($6 250 per month). Sounds like an OK living in the U.S. (unless you are in New York, San Francisco, Los Angeles, etc).

I went onto each of their LinkedIn pages and counted the number of employees. I assumed - rather generously - on average, only 50% of these "employees" are paid. The rest are advisors, investors, partners, etc.

I tried to count how much money each of the platforms will have left after receivi...more

Part 3 (of 3): SmallChange Regulation Crowdfunding (Reg CF) Educational Materials

Risks of investing

Many of the Securities listed on our Platform are speculative and involve significant risk, including the risk that you could lose some or all of your money. We’ve described some of the factors that make these investments risky in four ways:

- First, because many of the opportunities on our Platform will be in the real estate sector, we’ll describe risks common to that industry.

- Second, because many of the opportunities on our Platform will be in startup or early-stage companies, we’ll describe risks common to those companies.

- Third, we’ll describe risks common to many of the companies on the Platform, not covered in the real estate or startup categories.

- Fourth, we’ll describe risks associated with particular kinds of securities (e.g., debt securities or equity securities).

- Fifth, when you review a particular investment opportunity, the Issuer will also provide a list of risks specific to that opportunity.

The order in which these factors are discussed, either here on

Part 1 (of 3): SmallChange Regulation Crowdfunding (Reg CF) Educational Materials

How we work (for investors)

Regulation Crowdfunding (Reg CF) Educational Materials

This Investor Education Package is intended to provide you with important information about investing through our Funding Portal. Before investing, you should carefully review and understand this information. If you don’t understand something or have a question, please contact us via email at hello@smallchange.co.

This Investor Education Package applies only to offerings made under Title III of the JOBS Act. It does not apply to offerings made under Title II of the JOBS Act.

This document is intended to help explain:

- What we do, and how we do it.

- The process for buying securities through our Funding Portal.

- The limitations on the amounts you may invest.

- Your right to cancel your investment commitment.

- The circumstances in which the issuer may cancel your investment commitment.

- The risks associated with investing in the securities sold through our Funding Portal.

- The different typ

Named the 3rd Fastest Growing Company in Canada - for good reason

All founders and leaders know how hard growth is. Most days it comes as incremental steps - but sometimes, it's an exponential phenomenon that is powered by the incredible team you've built. This is one of those days.

With our office HQ in Toronto, but our satellite offices in Texas and Florida, we are proud to be named Canada's 3rd fastest-growing company for 2022. Although we are #3 overall, we are #1 in the Tech category.

We are building the 'Shopify solution' for the capital markets with a focus on making it easy for brands to transition from traditional venture capital (VC) raises to a more global, digital solution.

We are focused on serving our issuers and partners - which sets us apart from our competition. Crowdfunding portals are typically focused on attracting investors and providing value to them. Our technology is focused on powering up our partners to raise multiple deal types for multiple issuers AND providing a solid, innovative, end-to-end solution for issuers to ...more

SuperCrowd22: Will Local News be the Next Frontier for Investment Crowdfunding?

Tomorrow I will speak at SuperCrowd22 (see: https://www.supercrowd22.com ) - a two day event (September 15/16) - along with thought leaders and practitioners addressing issues at the cross section of impact investing + investment crowdfunding.

I am honored to be participating in this event.

I'll address the topic of "Will Local News be the Next Frontier for Investment Crowdfunding?"

I believe it's a topic of vital importance to our country and for the preservation of US democracy. At SuperCrowd, I'll speak to: 1) the current state of Local News media (it's not good) 2) a historical perspective on how we've gotten here and 3) a view on what can be done to help save or reinvigorate Local News across the country.

As a preview, here are some slides and facts from part one of my presentation - the current state of Local News.

Slide 2: The US loses two local newspapers each week! Since 2004, there has been a net loss of 2,514 papers.

...more

2021 CfPA Chairman's year-end address

Friday, December 31, 2021

Dear friends,

Thank you for another year far surpassing my hopes both personally and professionally.

The CfPA continues to be highly-regarded here and abroad as a generous and vital organization expanding access to capital and opportunity for entrepreneurs, small businesses and investors. Our work in 2021 helped Crowdfunding reach new highs, extended our global voice, and expanded our capacity domestically. We saw over $500M raised using RegCF offerings where even non-accredited investors finally got a piece of the pie. We saw RegA+ offerings land over $2B. For these, and so many other reasons, it continues to be an honor to be a part of a leadership team on the cutting edge of Alternative Finance. CfPA’s reputation continues to be enhanced by the many professionals who freely contribute their time and expertise to advancing the association and the industry. There have been so many noteworthy moments and I look forward to seeing even more debut in ’22.

In 2021...more

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

Raiseway

Raiseway

Small Change

Small Change

Dealmaker

Dealmaker