CrowdBanking -The Future of Finance

The following article was written as part of a keynote I gave for a Banking and Payments Conference in Africa, to introduce Bankers to the art of the possible in the banking and payments industry.

“General Partners (GPs) crowdfund from Limited Partners (LPs).” - Samson Williams

As a financial anthropologist, I find Humans in Venture Capital fascinating. The humans in Venture Capital (VC) are different from the culture of Venture Capital. Yes, humans do come together to build and create the culture of VC. But individually they are unique, and able to operate and make independent decisions without regard to so-called cultural norms. I bring this up because one of the odd relics of VC culture is that nearly universally, these otherwise independent and autonomous humans engaged in Venture Capital, fall victim to a cancerous myth of VC culture. What is that myth of VC lore? The strongly held misconception that crowdfunding is a resource only for businesses who can’t secur...more

Broker Dealers + RegCF = The Future

Hello Beautiful People!

A quick note to point out the obvious thing in RegCF...the Broker Dealers are joining The Crowd. Some bullet points for you to mull over:

- Last week $17.3M was committed to RegCF deals. This is probably up 100% from 2020 but you'll have to go to KingsCrowd.com to confirm.

- Note the #5 Funding Platform isn't actually a "Funding Portal" but a Broker Dealer.

- Who is Dalmore Group? And why should you care that BDs are swimming with The Crowd?

While there are only 65 FINRA registered Funding Portals, there are over 3200 Broker Dealers in the USA. BDs have far more access to capital than even Sharks do. To put it in terms more easily understood, if VCs are Sharks, Broker Dealers are Orcas. DYK that Orcas are the only seafaring creature that actively hunts Great White sharks?

SO! This is a big deal because BDs have access to institutional capital the likes of which VCs could never fathom accessing. What happens when institutional mone...more

DAOs + Crowdfunding = The Future of Finance

DAOs + Crowdfunding = The Future of Finance

We're going to skip the part where DAOs are engaging in unregulated crowdfunding for the moment. And instead, focus on what happens when hundreds or THOUSANDs of people use technology to do a thing.

1. Distributed Autonomous Organizations (DAO)s are where humans form an organization (some would call it a business but lets not get stuck in details) for the purpose of doing a thing.

2. #ConstitutionDAO formed so that its members could buy an original copy of the Constitution.

3. Calling it a DAO vs an LLC/Corp just means that members have some sort of #blockchain based ID that identifies them as members of the DAO.

4. DAOs are actually businesses because the members there in have a financial interest (represented by smart contracts /staking / shares etc....) in the thing the DAO was organized to do.

5. So its great that Humans are forming digital LLCs using blockchain ID (aka DOAs) as a form of identify and then together as The Crowd, engaging ...more

Crowdfunding in Trinidad - With barrister Brian Mondoh.

In this episode of This Call Is Being Recorded #TCIBR https://lnkd.in/eiMMrnhX we listen to a chat with Crowdfunding Professional Association President, Samson Williams and crowdfunding barrister Brian Sanya Mondoh on the state of investment crowdfunding in the USA and its potential in Trinidad and the Caribbean.

Click here to listen in: https://lnkd.in/eiMMrnhX

In this chat they discuss:

1. Barristers, what does that mean?

2. What happens when you lose $ in a protocol?

3. The state of investment crowdfunding in Trinidad

4. What are DAOs?

Looking forward to learning more about the state of crowdfunding in Trinidad and the Caribbean. In the meantime, don't forget to share and like this recording and join the CfPA.org for more info and insights into crowdfunding, globally.

...more

Problem with Reg CF Testing the Waters

Note - This is an email chain between Jenny Kassan and other CfPA members discussing the challenges of Testing The Water, that has been edited for brevity. While it is chucked full of useful information, it doesn't constitute legal, financial or compliance advise. As always consulting with a qualified lawyer or SME. This post is for educational purposes only. - Samson

Subject: problem with Reg CF Testing the Waters

From: Jenny Kassan

Oct 25, 2021, 10:07 PM

Hello! I don’t know if anyone has discussed this in our group but there is a big problem with Reg CF testing the waters under Rule 206.

If someone decides to publicly advertise the fact that they are considering doing a Reg CF offering under Rule 206 and then later decides not to do a Reg CF offering and that that they want to do a private offering of securities under Rule 506(b) or Rule 504 instead, they will pretty much be precluded from doing so theoretically forever!

This is because of the int...more

RegCF raised $1B dollars, so what?

Greetings Crowdfunding Community!

Two quick notes:

- I bumped into Sean O'Rielly from KingsCrowd yesterday and was telling him about when Kickstarter (launched in 2009) broke $1B dollars in rewards based crowdfunding pledges in 2014. Why that is important is because as of July 2021 Kickstarter has received more than $59B in pledges. You can see their full stats here: https://www.statista.com/statistics/310218/total-kickstarter-funding/

- Which brings us to point number two. As you may have read courtesy of Woodie and Crowdfund Insider, RegCF recently broke the $1B mark for funds raised. You can read about that here: https://www.crowdfundinsider.com/2021/10/182167-reg-cf-investment-crowdfunding-tops-1-billion-on-heals-of-funding-cap-increase/ Meaning that from 2016 to Q3 2021 RegCF has raised over $1B in funding.

Now, this is important for a number of reasons. Not just that because year to date, as of Q3 2021, ~$409M has been raised from 1,177 individual offerings. This is a ...more

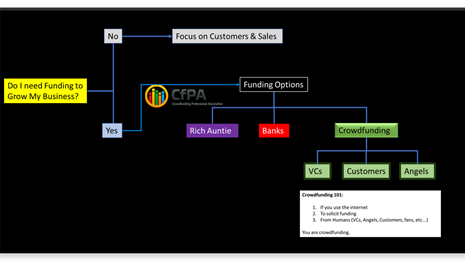

How to determine your funding options

To crowdfund or not to crowdfund?

The biggest paradigm shift in capital formation, post pandemic, is that every level of Investor and Founder has pivoted head on into #crowdfunding.

COVID19 forced Angels, VCs and Institutions online, ushering in a new era of FinTech adoption within capital formation. What was that fintech adoption? Platforms.

While the platforms have different regulatory requirements depending on the type of Crowd they're pursuing, they've all moved to digital platforms to facilitate funding.

GPs crowdfund for Funds from LPs on social media and private platforms, very similar to how Founders crowdfund for startup funds on social media using RegCF funding portals.

As Founders this is important for you to be aware of because regardless of The Crowd you're pursuing (VC, Angels, or Retail Investors) you'll be doing that online. So! If you have to pitch and pitch on online platforms, don't just pitch to a small audience. Pitch to the largest crowd you can get!

And that is t...more

3 Reasons why Going Public is going to clean the Shark’s tank.

TL;DR

- Customers have more money than VCs.

- Going Public empowers Founders to raise up to $75M via RegA+ crowdfunding while setting the investing terms for VCs, Sharks, Whales, Institutions and Customers alike.

- Nothing shows “traction” to Wall Street investors like raising money from 20,000 or 30,000 investomers.

First we should state the obvious thing. If you’re a Founder pitching to Sharks one at a time is the most inefficient way of raising capital. However, before JOBS Act Investment Crowdfunding you didn’t have a choice but to hustle around trying to find so-called “angels” and self-identified sharks and beg them for the opportunity to pitch. Now though, you don’t have to beg. Instead, through investment crowdfunding you have the opportunity to create an investment frenzy specifically for your business. No, this doesn’t make raising capital any easier. Raising capital is very similar to running a marathon. Even if you randomly find yourself at the starting line five mi...more