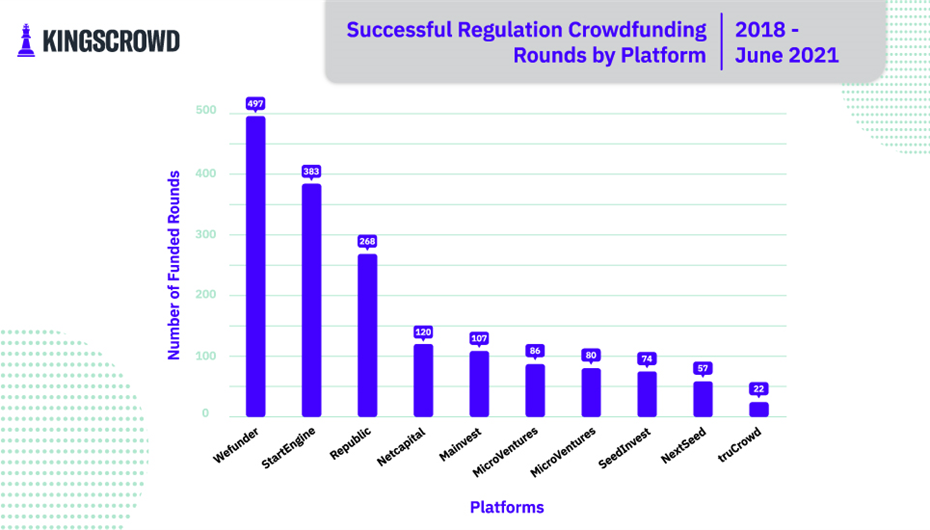

Hello Beautiful People and in particular Founders. Today we’re going to discuss the obvious and the elusive of investment crowdfunding. The obvious things being why WeFunder, StartEngine and Republic have the most “successful” crowdfunding campaigns and then the elusive definition of “successful” when it comes to what that means to you as a Founder. You can read more about their success to date in this KingsCrowd article: https://kingscrowd.com/chart-of-the-week-which-platforms-have-most-successful-deals/

First some quick, obvious, maybe even a little dirty things that you should be aware of:

- It takes money to make money and even more to raise money.

- If you’re considering launching a “successful” crowdfunding campaign you should be planning to spend a minimum of 6 months and $150k planning, launching, and nurturing your “successful” campaign to success.

- Raised money isn’t earned. You’ve got to pay it back. So while your “successful” crowdfunding campaign is definitely something you want to celebrate, as Biggie Smalls once said, “Mo money, mo annual investor reports, communications, compliance and of course actual business to run.”

Those three key items out of the way let's now discuss why the Big 3 of crowdfunding (WeFunder, StartEngine, Republic) are the Big 3 of Regulation Crowdfunding. Since you’re a busy Founder we’ll cut to the chase.

- They’ve been around the longest.

- They’ve all raised and pumped millions of dollars into advertising their platforms.

- They’re really good at strategic partnerships.

WeFunder launched in 2011, even before the JOBS Act was passed by Congress in 2012 and a full 5 years before Title III of the JOBS Act (that is what allows for RegCF crowdfunding) was signed into law by President Obama on May 16, 2016. Why this is important is because WeFunder paid the iron price and burned through 5 years of operational capital without doing much actual business. However, having paid the iron price they’ve captured much of the attention of the market and market share. Demonstrating that if you’ve got the deep pockets, it can be good to be early on in a new industry. Rounding out the top five of crowdfunding portals by age and market size is as follows:

- 2014 - StartEngine

- 2014 - NetCapital

- 2016 - Republic

- 2018 - MainVest

What is the moral these data points tell us? Well, if you launched early and raised millions of dollars to spend on Funding Portal operations (and a whole lot of education for Founders, Issuers and Investors) you too could be in the top 5 of crowdfunding portals.

What this means for Founders

As Founders you want to be sure that you select the crowdfunding platform that will help you achieve your ultimate goal of “successfully” raising funds. Will the Big 3 of crowdfunding help you do that better than any of the other 60+ Funding Portals who have also joined the investment crowdfunding market? Depends on your marketing budget.

As that is the “secret” to any successful crowdfunding campaign, you need money to execute it. Success in crowdfunding comes at a price. While there is no guaranteed method for success you should at a minimum plan on spending about 10% of the amount you want to raise, to raise the funds, up to the first $1M. After the first $1M the sunk cost of TRYING to raise money scale down. To make this a little more clear, if your funding goal is $500K, you should expect to spend about $50K (10%) TRYING to raise that amount.

Of course, there are numerous factors that could impact your success and/or ability to raise funds. For instance, a company came to me this week looking to raise $2M for a restaurant franchise but hadn’t filed taxes in five years. Now, this happens more often than you’d believe. Where startups / small businesses aren’t up to date on their tax filings. When raising capital it's generally recommended that you bring the administrative side of your business up to date before you even consider approaching investors. It doesn’t matter if you want to raise money from VCs, Angels or The Crowd each need to know the same data points to determine if you’re Investor Worthy. Part of those data points are up to date books / taxes. How much it costs to get your business’ taxes done isn’t actually part of the crowdfunding / capital raising process but you generally shouldn’t raise funds without them. Hence, why in order to crowdfund you may find yourself spending $10K - $30K getting your books in order...not including any taxes owed to the IRS / SALT.

Conclusion - Shop around.

The one thing to keep in mind about raising money and funding portals is that prior performance is no indication of future success. If you go to any crowdfunding platform you can word search that phrase and probably find it. So, as you consider which platform works best for your individual needs, check out the other 60+ crowdfunding platforms courtesy of FINRA and then select the one that makes the most sense for you. Too, keep in mind that if you’re in a specific vertical like real estate or entertainment then you may want to select a Funding Portal that specifically caters to those type of deals, like: www.SmallChange.com, www.BuyTheBlock.com, https://www.joinPistachio.com/, www.Fanvestor.com or WaterWorks https://www.wtrwrx.com/.

Good luck! May the odds and the algorithms forever be in your favor!

Samson

About the Author

Samson Williams is a serial entrepreneur and accidental investor. When not starting business with his enemies (“Entrepreneurship is hard. I only recommend it to my enemies.”), Samson is an Adjunct Professor at Columbia University in NYC and University of New Hampshire School of Law where he teaches on FinTech, Blockchain and The Space Economy. Samson is also President of the Crowdfunding Professional Association and investor into two investment crowdfunding platforms Brite.us - Crowdfunding Done Brite and GoingPublic.com. For more information on Samson visit www.SamsonWilliams.com and follow him on social @HustleFundBaby.

Register for FREE to comment or continue reading this article. Already registered? Login here.

2