Why I Support the SEC's Tentative Plan to Raise a Key Crowdfunding Threshold

An SEC Committee Voted to Recommend Raising the Trigger for Reviewed Financial Statements from $124,000 to $350,000

I’m not a financial advisor; Superpowers for Good should not be considered investment advice. Seek counsel before making investment decisions.On Monday, the Securities and Exchange Commission’s Small Business Capital Formation Advisory Committee, a key organization within the financial market’s regulator, voted to recommend raising the threshold for requiring reviewed financial statements under Regulation Crowdfunding from $124,000 to $350,000. Let me explain why I enthusiastically support that recommendation!

What Is a Reviewed Financial Statement?

One of the pernicious problems associated with reviewed financial statements is that the name “reviewed” fails to describe what it is to anyone but a CPA. It sounds a bit like I’ve handed my financial statements to an auditor and asked them to peruse them and then stamp them “reviewed.” That is completely wrong!

Essentials to Know When Marketing a Reg A or Reg CF Capital Raise

Regulation A (Reg A) and Regulation Crowdfunding (Reg CF) offer alternatives to traditional financing such as bank loans, venture capital, or initial public offerings (IPOs). While traditional financing typically involves stringent eligibility criteria, a lengthy approval process and substantial fees, Reg A and Reg CF provide greater flexibility for raising capital.

- Marketing a Reg A or Reg CF capital raise involves understanding the target audience, crafting compelling messages, and utilizing multiple channels such as social media, email campaigns, and press releases

- Compliance with SEC regulations is crucial for issuers, including adherence to advertising restrictions and providing accurate and comprehensive information about the offering

- The Reg A & Crowdfunding Conference 2024 hosted June 20 by DealFlow Events promises to deliver valuable insights on marketing strategies, deal activity projections, IP protection, and more

- Companies actively considering Reg A or Reg CF may qual

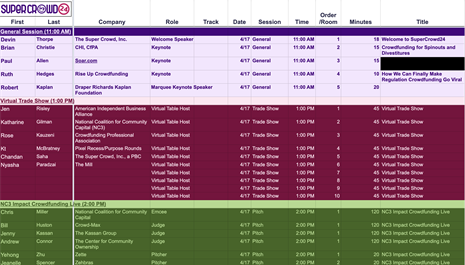

Grateful for the super people at SuperCrowd24

On behalf of the Crowdfunding Professional Association (CfPA), I would like to express gratitude to @Devin Thorpe and @Chandan Saha for providing CfPA with the opportunity to co-host SuperCrowd24 and for giving the CfPA board and members the opportunity to share their perspectives and expertise and to connect with a community of attendees from all over the world. The event was highly engaging and informative (-- and provided a welcome diversion following the end of this year’s tax season).

The agenda was packed, the speakers were amazing, and the topics were relevant across a wide range of themes. Personally, I was pleased to hear numerous discussions about the possible integration of regulated investment crowdfunding into the full capital stack of various businesses -- from small enterprises seeking SBA loans to major corporations managing complex divestitures – as it points to a future where crowdfunding and community-ownership could be an important pro-social subs...more

SuperCrowdBaltimore

SuperCrowdBaltimore, the event you've been waiting for, is now on March 21, 2024. Learn from top-notch speakers and network with industry experts.

Use code "CfPA" for 30% off your ticket!

Register here: https://thesupercrowd.com/supercrowdbaltimore

...moreWill private inurement issues prevent a nonprofit from investing in a mission-driven worker coop?

Hello Everyone!

Equal Exchange is conducting an offering on Crowdfund Mainstreet. They are offering a 3% promissory note. Equal Exchange is a worker-owned cooperative that helps small farmers worldwide compete in the fair trade marketplace. Due to their amazing impact and the nature of their work, they have attracted the interest of some 501(c)(3) organizations that would like to participate. A question has come up regarding private inurement because the interest rate of 3% is below the AFR. Does anyone have any experience with this issue?

It would be unfortunate to have to turn these investors away as they could help legitimize these kinds of offerings.

Any thoughts are appreciated.

Thanks,

Michelle

...moreDive into the World of Crowdfunding Excellence with SuperCrowdHour February 2024!

Attention all crowdfunding enthusiasts and aspiring changemakers! The highly anticipated SuperCrowdHour event for February 2024 is just around the corner, and we couldn't be more thrilled to welcome you!

Countdown Begins: With the event date fast approaching, mark your calendars for February 21, 2024, at 1:00 PM Eastern. Get ready to dive deep into the world of crowdfunding excellence!

https://www.youtube.com/watch?list=TLGGSFSdz8WDyigxODAyMjAyNA&v=HoQyB5CFHLA

Meet the CFPA Leaders: Join us as we host the esteemed Crowdfunding Professional Association (CFPA) leaders:

- Brian Christie, CFPA President

- Jenny Kassan, CFPA Vice President

- Brian Belley, CFPA Secretary

- Scott McIntyre, CFPA Chair

What to Expect: Gain exclusive insights, connect with industry experts, and learn how you can make a difference in the crowdfunding community. SuperCrowdHour is your gateway to unlocking new opportunities and achieving crowdfunding success!

Special Incentive: Remember, attendees who register for an...more

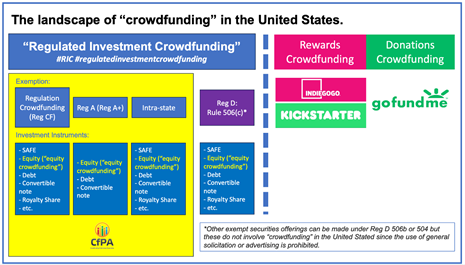

CfPA Recommended Best Practice: “Regulated Investment Crowdfunding”

The MEMO below was posted for the industry by CfPA 2024 President, Brian Christie

MEMORANDUM

TO: All Industry Participants in the Regulated Investment Crowdfunding Industry

CC: CfPA Board of Directors

FROM: Brian Christie, President (2024), Crowdfunding Professional Association, 501(c)(6)

DATE: February 16, 2024

SUBJECT: CfPA Recommended Best Practice: “Regulated Investment Crowdfunding”

______________________________________________________________________

Dear Industry Colleague:

I am writing on behalf of the Crowdfunding Professional Association (CfPA) to inform you of an industry Recommended Best Practice that was adopted and approved by the CfPA Board of Directors on January 8th, 2024.

The CfPA board recommends that all industry stakeholders hereby use the term 'Regulated Investment Crowdfunding' as an umbrella term and when referring to transactions, activities, and operations that may involve non-accredited investors a...more

Crowdfunding and Investment Banking for Start Ups

Crowdfunding definitely is not easy, but many companies have already proven that it’s certainly worthwhile when done properly. However, startup companies sometimes feel they’re left in limbo with no resources at their disposal. Listen to our latest Mapable USA podcast where Manuj Grover from Public Yield Capital and Kevin Morris from Atlas Road explain how to build a brand and turn your loyal customers into investors to help your company grow, regardless of your size. It’s all about building a community and having an excellent customer service and an overall experienced team to help facilitate the process.

Are you a startup company wondering if the crowdfunding space is for you? Well, we have good news! The crowdfunding industry is maturing and as such, a larger number of quality deals are out there. But how do they start and what steps should business owners follow for success? How can companies solve the first challenge of crowdfunding: getting your investo...more

The Reg A & Crowdfunding Conference

The Reg A & Crowdfunding Conference

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)