Get Ready for SuperCrowd24 - The Ultimate Virtual Crowdfunding Experience!

We hope this message finds you well and thriving! We are thrilled to bring you the latest update on an event that promises to revolutionize your understanding of crowdfunding and investment – introducing SuperCrowd24!

📅 Save the Date: April 17-18

📍 Location: Your Screen - It's a Virtual Event!

Get ready for an immersive experience at the impact crowdfunding event of the year! SuperCrowd24 is designed to connect investors, entrepreneurs, and enthusiasts from around the world, all from the comfort of your home.

What to Expect: ✨ 100 Expert Speakers: Learn from the best in the business as 100 industry leaders share their insights and strategies for successful crowdfunding and investment.

🎙️ Live Pitch Sessions: Witness entrepreneurs pitch their groundbreaking ideas in real-time! Who knows, you might discover the next big thing to add to your portfolio.

💡 Learn to Invest Like a Pro: Whether you're a seasoned investor or just starting, SuperCrowd24 offers valuable tips and techniques ...more

2023 Investment Crowdfunding Infographics

It's a wrap! 2023 was a game of chess for investment crowdfunding. Dealflow came under pressure, but investor confidence was strong in terms of average check size and total amount of capital deployed. More established issuers came to the table, and women and minorities ended up being some of the biggest beneficiaries. It seems like the economy is poised for the soft landing the Fed was aiming for which means 2024 should be a great year for RegCF as long as geo-policial events don't take over. Here are a couple of infographics that highlight some of the key points in our 120-page annual report coming out shorty! Contact sales@theccagroup.com If you are interested in the paid report.

...more

Funding Impact Startups: How They Compare to Broader Market Investments

Explore how impact investing equity and debt deals fare against the broader crowdfunding market since May 2022, with insights on median and average funding amounts, and investor preferences.

Reposted from KingsCrowd. Written by Léa Bouhelier-Gautreau.

This week, we compare the median and average amounts invested in impact investing equity and debt deals with the amounts invested in all crowdfunding deals. Our data encompasses every Reg CF and Reg A deals since May 2022.

- For equity deals, the median amount raised by impact deals is higher than that of any deals. This means that investors tend to invest more in impact investing deals.

- However, the average amount invested in impact investing deals is smaller than that in most deals. This is because only four impact deals reached $5 million in funding. This is a small portion of the 20 deals that reached $5 million or more in funding. Five of these deals received $10 million to $50 million in funding.

- Overall, impact invest

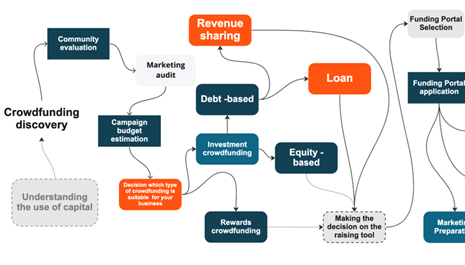

Not all “Crowdfunding” is Created Equal: Navigating a Terminology Maze and the Oculus Case Study

In the dynamic realm of crowdfunding, different models have emerged to cater to different fundraising needs. However, a common pitfall lies in the tendency to conflate "donations crowdfunding," "rewards crowdfunding," and "regulated investment crowdfunding." While these models share a common term - “crowdfunding” - they are very different and serve distinct purposes.

Donations Crowdfunding is typified by platforms like GoFundMe and involves raising funds for personal causes without an obligation to provide a product. Someone has a hospital bill and they appeal to donors. “Donors” not “Investors.” In other words, there is not the expectation or obligation of a “return” of any kind with donations crowdfunding.

Rewards Crowdfunding is a popular model exemplified by platforms like Kickstarter and Indiegogo and it allows creators to pre-sell a product or service to backers. “Backers” not “Investors.” In other words, contributors or backers receive tangible rewards in return for ...more

Unlocking Growth: How Customer-Shareholders from Crowdfunding Can Boost Lifetime Value and Enterprise Value

Increasingly, companies are turning to Regulated Investment Crowdfunding as a strategy to raise capital and convert their customers into investors or “investomers” as many have coined the phrase. As companies consider this business strategy, it’s important they understand the concept of Lifetime Value (LTV) and its impact on Enterprise Value (EV). LTV, short for Lifetime Value of a Customer, quantifies the total revenue a business can expect to earn from a single customer throughout their entire relationship with the company. EV, on the other hand, represents the total value of a business, including its debt and equity. These crucial metrics help businesses assess their long-term profitability and overall worth.

Investment Crowdfunding is not only a way to enhance LTV but also a way to drive up EV. I recently read a white paper by the company Dealmaker entitled “The Bottom-Line Value of Turning Customers into Shareholders” which cited research and s...more

DeRosa Group: CfPA Crowdfunding Issuer Interview Series

The DeRosa Group is a family-owned business that invests in residential and commercial properties, with a mission of "Transforming Lives Through Real Estate." It was founded by Matt and Liz Faircloth in 2004. Their journey began with the purchase of a modest duplex just outside of Philadelphia, fueled by a $30,000 private loan. Since then, they have mastered the art of optimizing properties for their highest and best use, revolutionizing single-family homes, multi-family residences, apartments, mixed-use spaces, and retail outlets, as well as offices. This interview was conducted with Herve Francois.

INTERVIEW

CFPA: Can you tell us a little bit about your company? What does your company do and at what stage is it?

Herve Francois: DeRosa Group is a real estate investment company that invests in large multifamily apartment complexes. Our motto, "Transforming Lives Through Real Estate" is all about improving the living situation of our tenants by providing them an attractive plac

How funding portals can reduce CAC & CIC:

Posted at 8/14/2023

Cost of Investor Acquistion

Creating institutional capital investment pools with funding portals is hugely important. Honeycomb Credit has trailblazed that with a foundation. You can go to pension funds, banks, insurance companies, credit unions, etc with these kinds of proposals. Point to HoneyComb's success story, differentiate your portal.

Side-note: would love to start seeing partnerships between niche portals.

If you aren't ready to do that yet, and are starting off with founders in your direct network, I would fill your relevant social media channels (that you send to people) with accessible and engaging demos of your product from the investor's perspective. Of course, content for business owners is important too... but think about it this way: fundraising businesses will be sending your social media content to their investors as to explain how the process is going to go.

Educational content on why your niche and portal serve a critical need. Explain to investors, why their investm...more

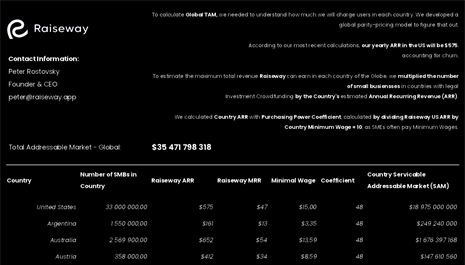

How we calculated Raiseway's Global Total Addressable Market

Disclaimer: (1) the issuer is considering an exempt offering, but has not decided upon any particular exemption; (2) the issuer is not soliciting any money or other consideration and, if sent, will not be accepted by the issuer; (3) the issuer will not sell securities or accept commitments to purchase securities until the issuer decides on which exemption it will pursue and satisfies any required filing, disclosure or qualification requirements; and (4) all indications of interest made by solicitees are non-binding.

To calculate Global #TotalAddressableMarket, we needed to understand how much Raiseway will charge users in each country.

We developed a global parity-pricing model to figure that out.

According to our most recent calculations, our yearly Annual Recurring Revenue (ARR) in the US will be $575, accounting for churn.

(^This isn't exactly right, we need to update the model. When we do, the TAM numbers will move by a n million, not sure which direction. 🤡 )

...more

KingsCrowd

KingsCrowd

Crowdfunding Professional Association (CfPA)

Crowdfunding Professional Association (CfPA)

Raiseway

Raiseway