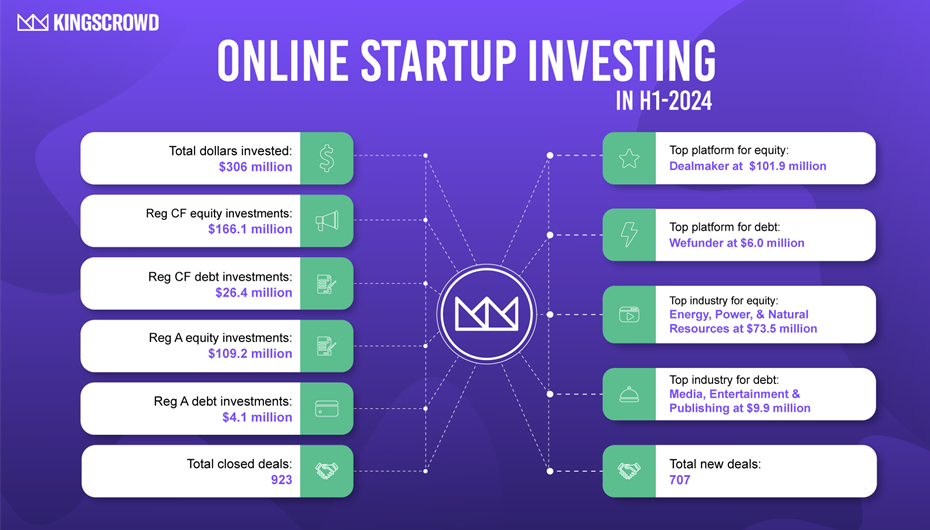

In the first half of 2024, $306 million was invested online through Regulation Crowdfunding (Reg CF) and Regulation A (Reg A+). There are a few key trends that we continue to see in the market:

- Reg CF investments continue to outpace Reg A+ investments (excluding Reg A+ real estate and fractional collectible offerings): despite the $5 million vs. $75 million cap on Reg CF and Reg A+, respectively, Reg CF saw $192 million invested in the first half of 2024 compared to $113 million for Reg A+.

- Debt and revenue share offerings continue to attract fewer investment dollars than equity offerings as a whole, seeing 10.0% ($30.5 million) of all online investments in H1-2024, compared to equity deals attracting $275.6 million in investments.

- Dealmaker Securities was the top platform for Reg CF and A+ equity raises ($101.9 million), while Wefunder took the top spot for debt raises ($6.0 million). The complete breakdown of top Reg CF and Reg A+ platforms for the first half of 2024 is discussed in more detail below.

- The top industry for equity raises continues to be the capital-intensive Energy, Power & Natural Resources industry ($73.5 million in investments), while the Media, Entertainment & Publishing industry saw the most invested ($9.9 million) for debt deals.

- Overall online investment volume saw a ~9% decline in the first half of 2024 compared to the same period in 2023.

Online Startup Investing Trends of 2024

We continue to see several interesting trends in the regulated investment crowdfunding markets. Whether it’s the continued outperformance of Reg CF vs. Reg A+, seeing more mature companies raising capital under Reg CF, and the continued strong performance of some of the top funding platforms, we can glean some key insights from the data in the first half of the year.

How has 2024 compared to 2023 so far?

Despite the public markets hitting new all-time highs in 2024, Reg CF and Reg A+ investments saw slight declines in total investments compared to the first half of 2023:

| Reg A+ | Reg CF | Total | |

| H1-2023 | $ 121.5 million | $ 213.2 million | $ 334.8 million |

| H1-2024 | $ 113.2 million | $ 192.2 million | $ 305.7 million |

| Change | -6.8% | -9.7% | -8.7% |

While Reg CF saw a higher year-over-year decline compared to H1-2023, it’s important to note that Reg CF investment volume in the first half of 2024 was still 1.7 times more than Reg A+ investment volume.

The overall declines suggest that investors may still be avoiding risk in the early-stage private markets. Anecdotally, we have heard that many online startup investors have slowed their pace of investing or even put their investments on hold as they wait to observe how their 2020-2022 vintage of startup investments will ultimately fair.

Top Raises of H1-2024

However, this does not mean that there have not been hugely successful raises in 2024 thus far. In fact, of raises that closed in the first half of 2024, two (2) Reg CF raises have hit the $5 million cap and five (5) Reg A+ raises raised more than $4.5 million:

| Company | Platform | Valuation | Amount Raised | Start Date | Close Date | Reg Type |

| Aptera Motors | Dalmore Group | $795,000,000 | $40,500,075 | 12/19/2022 | 7/2/2024 | RegA+ |

| TradeAlgo | Dalmore Group | $375,000,000 | $5,308,800 | 7/21/2023 | 6/30/2024 | RegCF |

| WiGL | StartEngine | $147,000,000 | $8,244,919 | 11/30/2021 | 3/26/2024 | RegA+ |

| Flower Turbines | StartEngine | $124,570,000 | $4,558,015 | 2/17/2023 | 2/22/2024 | RegA+ |

| ACME AtronOmatic | StartEngine | $70,000,000 | $4,996,310 | 7/19/2023 | 2/19/2024 | RegCF |

| Autonomix | Dealmaker Securities | $70,000,000 | $6,200,610 | 10/19/2023 | 1/29/2024 | RegA+ |

Several of these large Reg A+ raises had been open since 2022 or 2023. Thus, a portion of the funds raised in those campaigns actually came in prior to 2024.

Reg CF Seems to be Attracting More Mature Issuers

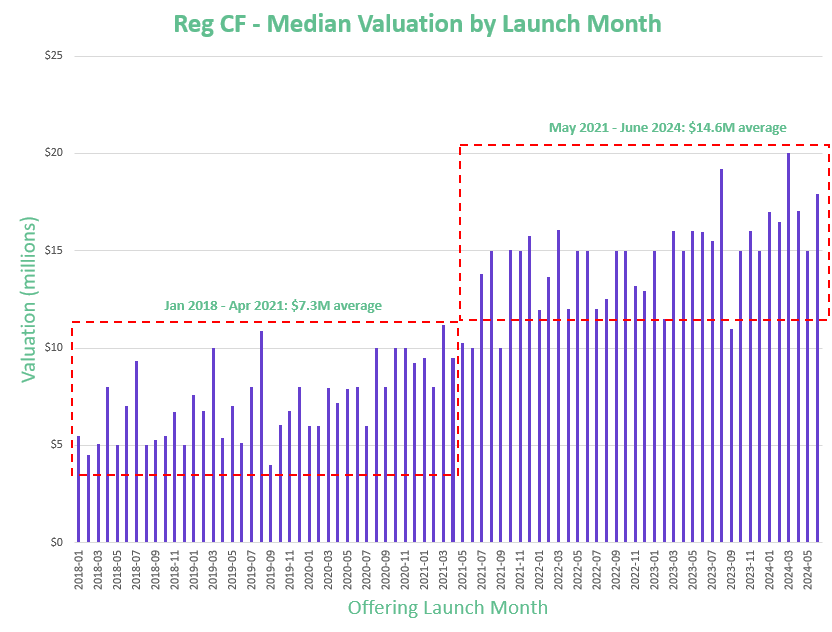

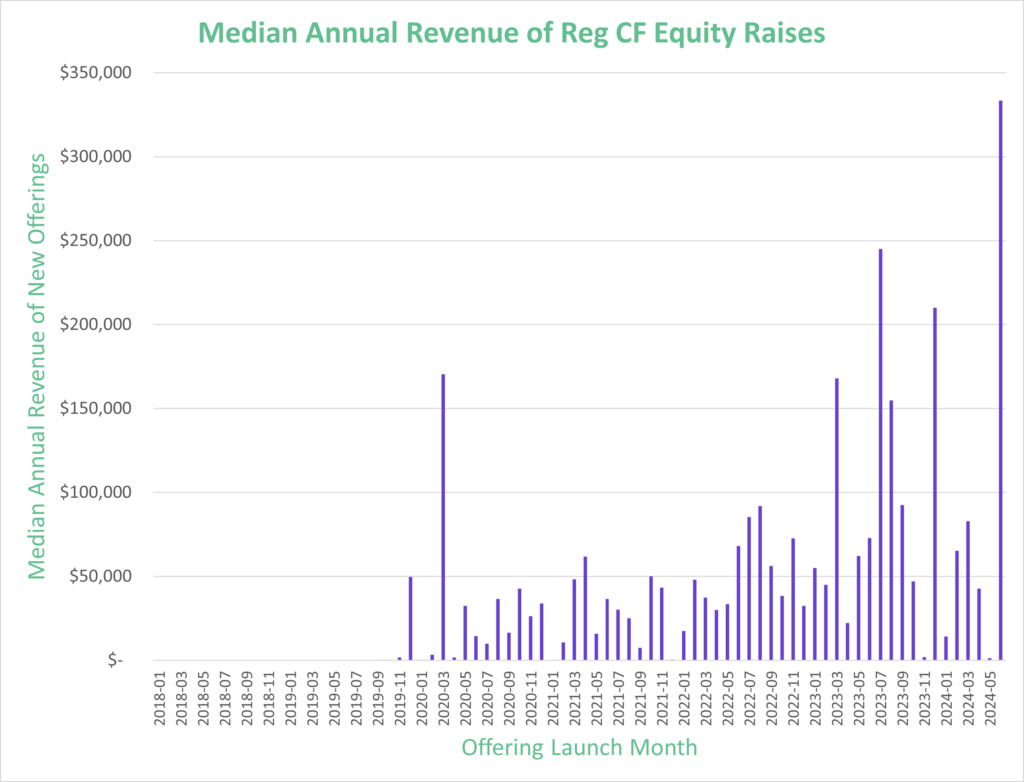

Since the 12-month capital limit was raised to $5 million in March 2021 – which also preceded the local top in the public markets in late 2021 – it seems that more mature companies have been turning to Reg CF. We can see this both in terms of valuation trends before and after 2021, as well as in the median annual revenues of issuers over time.

This may be due to:

- Reg CF’s lower cost of capital compared to Reg A+ and companies being more tight with their finances since the rise of interest rates

- The ability to raise up to $5 million under Reg CF since March 2021, driving more issuers that would have used Reg A+ to turn to Reg CF instead

- More widespread adoption among VCs and mature companies of raising a community round (such as the recent beehiiv raise)

First, we can see this when looking at median valuation trends in Reg CF equity-based offerings:

As seen in the above chart, the median monthly valuation from Jan. 2018 to April 2021 was $7.3 million on average. However, after the regulation changes in Q1 2021, the median valuation of new Reg CF offerings through June 2024 has been double that, $14.6 million on average.

To show that this trend isn’t simply a matter of increasing valuations, we can also look at the median annual revenues of new offerings. There have been numerous months since 2023 where the median annual revenue of new offerings has exceeded $150,000 (with the median Reg CF issuer in June 2024 exceeding $330,000!). This is in stark contrast to 2019 and before, where the median Reg CF issuer was pre-revenue (i.e. $0 annual revenue).

Thus, it’s safe to say that the “typical” Reg CF issuer of 2024 does tend to have more traction (via revenue and valuation) compared to issuers of 2021 and earlier.

Top Funding Platforms of 2024

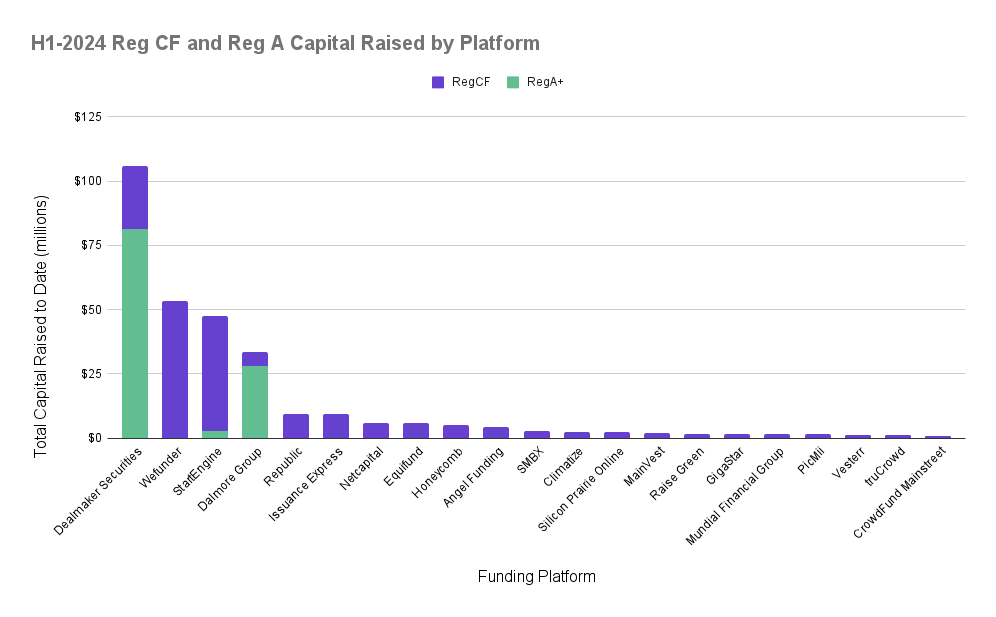

The first six months of 2024 saw many of the same funding platforms continue to have strong performance.

While Wefunder and StartEngine came in number 1 and 2 respectively for Reg CF, Dealmaker actually took the overall top spot when including Reg A+ capital raised during the first half of 2024.

In total, there were 21 platforms that raised at least ~$1 million or more during the first half of 2024:

Total online capital raised by top funding platforms from January 1, 2024 through June 30, 2024:

| Platform | Reg A+ | Reg CF | Grand Total |

| Dealmaker Securities | $81,556,604 | $24,290,913 | $105,847,517 |

| Wefunder | $53,384,860 | $53,384,860 | |

| StartEngine | $2,894,411 | $44,587,627 | $47,482,038 |

| Dalmore Group | $28,114,036 | $5,485,311 | $33,599,347 |

| Republic | $226,182 | $9,315,925 | $9,542,107 |

|

Issuance Express

|

$9,399,108 | $9,399,108 | |

| Netcapital | $6,069,356 | $6,069,356 | |

| Equifund | $5,903,135 | $5,903,135 | |

| Honeycomb | $5,129,832 | $5,129,832 | |

| Angel Funding | $4,411,063 | $4,411,063 | |

| SMBX | $2,641,250 | $2,641,250 | |

| Climatize | $2,361,115 | $2,361,115 | |

| Silicon Prairie Online | $63,000 | $2,167,145 | $2,230,145 |

| MainVest | $2,135,000 | $2,135,000 | |

| Raise Green | $1,547,400 | $1,547,400 | |

| GigaStar | $1,513,486 | $1,513,486 | |

|

Mundial Financial Group

|

$1,505,700 | $1,505,700 | |

| PicMii | $1,468,403 | $1,468,403 | |

| Vesterr | $1,206,700 | $1,206,700 | |

| truCrowd | $1,035,481 | $1,035,481 | |

|

CrowdFund Mainstreet

|

$917,107 | $917,107 |

Register for FREE to comment or continue reading this article. Already registered? Login here.

2

Good job