Are founders putting themselves at risk if they reveal their fundraising plans on a public forum like Twitter?

Yes! It is amazing how common it is for founders to publicly pitch investments in their companies. This is not always illegal. There are some securities exemptions under which this is allowed (e.g. Regulation Crowdfunding (but with some limitations) and Rule 506(c)). But most founders have not consciously chosen a securities exemption so they may inadvertently be breaking the law.

Are founders putting themselves at risk if they reveal their fundraising plans on a public forum like Twitter?

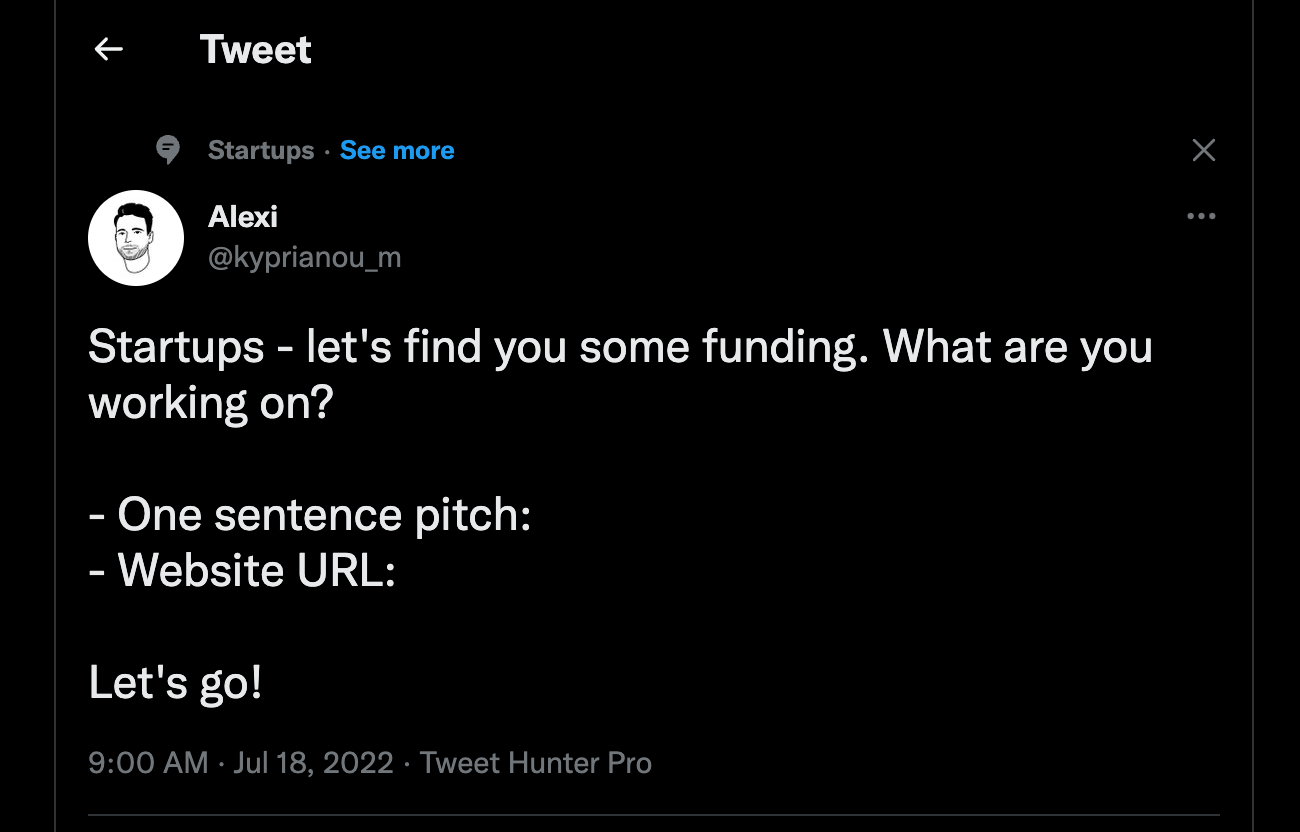

This tweet -- and the many public responses where founders publicly revealed their fundraising status and plans -- prompted the question. #crowdfundingeducation

https://twitter.com/kyprianou_m/status/1549016138515972097?s=20&t=nTu6epYBcI-euGv2X59dsQ

Yes! It is amazing how common it is for founders to publicly pitch investments in their companies. This is not always illegal. There are some securities exemptions under which this is allowed (e.g. Regulation Crowdfunding (but with some limitations) and Rule 506(c)). But most founders have not consciously chosen a securities exemption so they may inadvertently be breaking the law.

Having worked as an investment banker in the days before the JOBS Act, I've got to say that the new rules are wonderful. It is easy to violate them, but they do allow for people to publicly raise money by carefully following great legal advice like you give, Jenny.