- Home

- Q&A

-

Can funding portals do sales and marketing activities to solicit investors on behalf of the issuers on their portal?

Unless the portal is a licensed broker-dealer, it may not offer investment advice or recommendations or solicit purchases, sales, or offers to buy the securities offered or displayed on its platform.

It may however apply objective criteria to highlight offerings on its platform where:

(i) The ... more

Unless the portal is a licensed broker-dealer, it may not offer investment advice or recommendations or solicit purchases, sales, or offers to buy the securities offered or displayed on its platform.

It may however apply objective criteria to highlight offerings on its platform where:

(i) The criteria are reasonably designed to highlight a broad selection of issuers offering securities through the funding portal’s platform, are applied consistently to all issuers and offerings and are clearly displayed on the funding portal’s platform;

(ii) The criteria may include, among other things, the type of securities being offered (for example, common stock, preferred stock or debt securities); the geographic location of the issuer; the industry or business segment of the issuer; the number or amount of investment commitments made, progress in meeting the issuer’s target offering amount or, if applicable, the maximum offering amount; and the minimum or maximum investment amount; provided that the funding portal may not highlight an issuer or offering based on the advisability of investing in the issuer or its offering; and

(iii) The funding portal does not receive special or additional compensations for highlighting one or more issuers or offerings on its platform.

less3 -

What is a SAFE (Simple Agreement for Future Equity) and how does it relate to investment crowdfunding?

A SAFE is an investment vehicle which allows investors to invest in a company in exchange for the future equity it holds. Similar to a stock option, it is commonly used within the context of investment crowdfunding.

Stock option agreements and safe instruments used in crowdfunding are similar in tha... more

A SAFE is an investment vehicle which allows investors to invest in a company in exchange for the future equity it holds. Similar to a stock option, it is commonly used within the context of investment crowdfunding.

Stock option agreements and safe instruments used in crowdfunding are similar in that they both provide investors with a way to invest in a company without having to purchase shares of stock. They both provide investors with a way to invest in a company without having to take on the risk of owning shares of stock.

They also both provide investors with a way to invest in a company without having to pay the full price of the stock.

However, the main difference between the two is that stock option agreements provide investors with the right to purchase shares of stock at a predetermined price, while safe instruments provide investors with the right to receive a predetermined amount of money if the company is successful.

less2 -

How can Assurely be a partner to the crowdfunding platforms that support companies raising capital? How can Assurely be a partner to the crowdfunding platforms that support companies raising capital?

Assurely’s TigerMark Directors and Officers Insurance is the leading insurance product for companies raising capital using the internet and the Partners that support them. As a company, our primary goal is to benefit all stakeholders within the crowdfunding industry, including investors, Issuers, an... more

- Regulations & Compliance

- Insurance

-

How is 506(b) related to crowdfunding?

506(b) offerings are not typically considered to be a form of crowdfunding. Crowdfunding generally refers to a method of raising funds from a large number of people, often through online platforms, in exchange for equity or other forms of compensation.

506(b) offerings, on the other hand, are privat... more

506(b) offerings are not typically considered to be a form of crowdfunding. Crowdfunding generally refers to a method of raising funds from a large number of people, often through online platforms, in exchange for equity or other forms of compensation.

506(b) offerings, on the other hand, are private placements that are typically offered to a limited number of accredited investors. While crowdfunding can also be used to raise funds from accredited investors, it often involves a much larger number of investors who may not meet the SEC's accreditation requirements.

However, it's worth noting that some online platforms have emerged that allow companies to conduct 506(b) offerings through crowdfunding-like platforms. These platforms typically provide tools and services to help companies comply with the SEC's regulations regarding private placements and may allow companies to market their offerings to a broader range of accredited investors. These types of platforms are sometimes referred to as "accredited crowdfunding" or "equity crowdfunding for accredited investors."

Overall, while there are some similarities between 506(b) offerings and crowdfunding, they are typically considered to be distinct methods of raising capital, with different regulatory requirements and target audiences.

less -

What is a good way to find impact investment opportunities that are currently crowdfunding?

Thanks for the great question. With nearly 90 FINRA regulated funding portals and thousands of broker dealers all eligible to facilitate issuers for their crowdfunding raises, you aren't alone in looking for deals that meet certain characteristics (e.g. impact investments). Luckily, there do exist a... more

Thanks for the great question. With nearly 90 FINRA regulated funding portals and thousands of broker dealers all eligible to facilitate issuers for their crowdfunding raises, you aren't alone in looking for deals that meet certain characteristics (e.g. impact investments). Luckily, there do exist aggregators that collect data about live offerings and sort them into categories.

KingsCrowd is one such aggregator and you can find companies with live offerings that they've sorted as having "Social Impact" by clicking on this link: https://kingscrowd.com/companies/search/?social_impact=true&status=Active I believe they have a team of analysts that tag issuers with certain labels to make them easier to sort.

Another place where you can learn more generally about companies operating at the intersection of impact investing and crowdfunding is at the SuperCrowd conference where companies, including impact companies with live offerings, pitch, present, and discuss case studies. It's a major gathering of leaders in this sector and you can find more info here: https://thesupercrowd.com

#impactinvesting #socialimpact @Devin Thorpe @Brian Belley

less -

Meseret (Messi) Warner answered 3/17/2023

What is the potential for crowdfunding in Africa?

Crowdfunding in Africa is in its infancy stage of development. Just like in the U.S., donation and reward-based crowdfunding has been trying to take hold in the market for the last several years. That said, equity crowdfunding is springing around since 2015/16 with its potential being recognized by ... more

Crowdfunding in Africa is in its infancy stage of development. Just like in the U.S., donation and reward-based crowdfunding has been trying to take hold in the market for the last several years. That said, equity crowdfunding is springing around since 2015/16 with its potential being recognized by governments and the development/donor community including ours (https://igniteinvestment.com/) launched in September 2022.

With over 80% of African businesses being Small and Medium Enterprises (SMEs) facing a critical lack of access to finance because of collateralized debt financing, the potential for crowdfunding is estimated to reach over 2 Billion in sub-Sahara Africa by just 2025. I also know that Wefunder and Republic have been eyeing around the African equity crowdfunding market. In fact, I actually participated in one of Republic's Twitter spaces event talking about how African company fundraised on their platform.

Hope this help and have a look at these two articles that may give you some more information: https://www.un.org/africarenewal/magazine/july-2022/crowdfunding-emerging-financing-source-african-entrepreneurs#:~:text=Forecasts%20now%20show%20that%20crowdfunding,cent%20of%20the%20global%20market.

https://link.springer.com/chapter/10.1007/978-3-030-46309-0_14

less -

What is the attitude toward private market access by the author of the following statement?

The Commission should examine ways to expand their access to capital, but it should do so in a way that mitigates the risks posed by offering investors fewer or no protections.

The author of this statement has a critical attitude towards private market access. They argue that retail investors lack th... moreThe Commission should examine ways to expand their access to capital, but it should do so in a way that mitigates the risks posed by offering investors fewer or no protections.

The author of this statement has a critical attitude towards private market access. They argue that retail investors lack the bargaining power and resources to access the same investments as venture capitalists, and they caution against expanding market access without better protections for investors. They ultimately advocate for increased access to capital, but argue that it must be done in a way that reduces risk for investors. less2 -

Why are VCs considered gatekeepers?

VCs, or venture capitalists, are considered gatekeepers because they play a significant role in determining which startups and entrepreneurs receive funding and support. VCs typically have significant financial resources and expertise in evaluating the potential success of new businesses.

Startups o... more

VCs, or venture capitalists, are considered gatekeepers because they play a significant role in determining which startups and entrepreneurs receive funding and support. VCs typically have significant financial resources and expertise in evaluating the potential success of new businesses.

Startups often rely on funding from VCs to get their businesses off the ground and to scale their operations. VCs are known for providing more than just financial support, often offering advice, guidance, and mentorship to the entrepreneurs they fund.

Because of their significant role in the startup ecosystem, VCs have the power to act as gatekeepers, controlling access to funding and resources that can be crucial to the success of a startup. This means that entrepreneurs may need to meet certain criteria, such as having a certain level of experience or connections, in order to gain access to VC funding.

Additionally, VCs often prioritize investments in certain industries or types of startups, which can further limit access to funding for entrepreneurs in other sectors or with different business models. This has led to criticism that VCs may not always invest in the most innovative or diverse startups, and may instead favor those that fit within their existing investment strategies and portfolios.

less- Unclassified

-

3

-

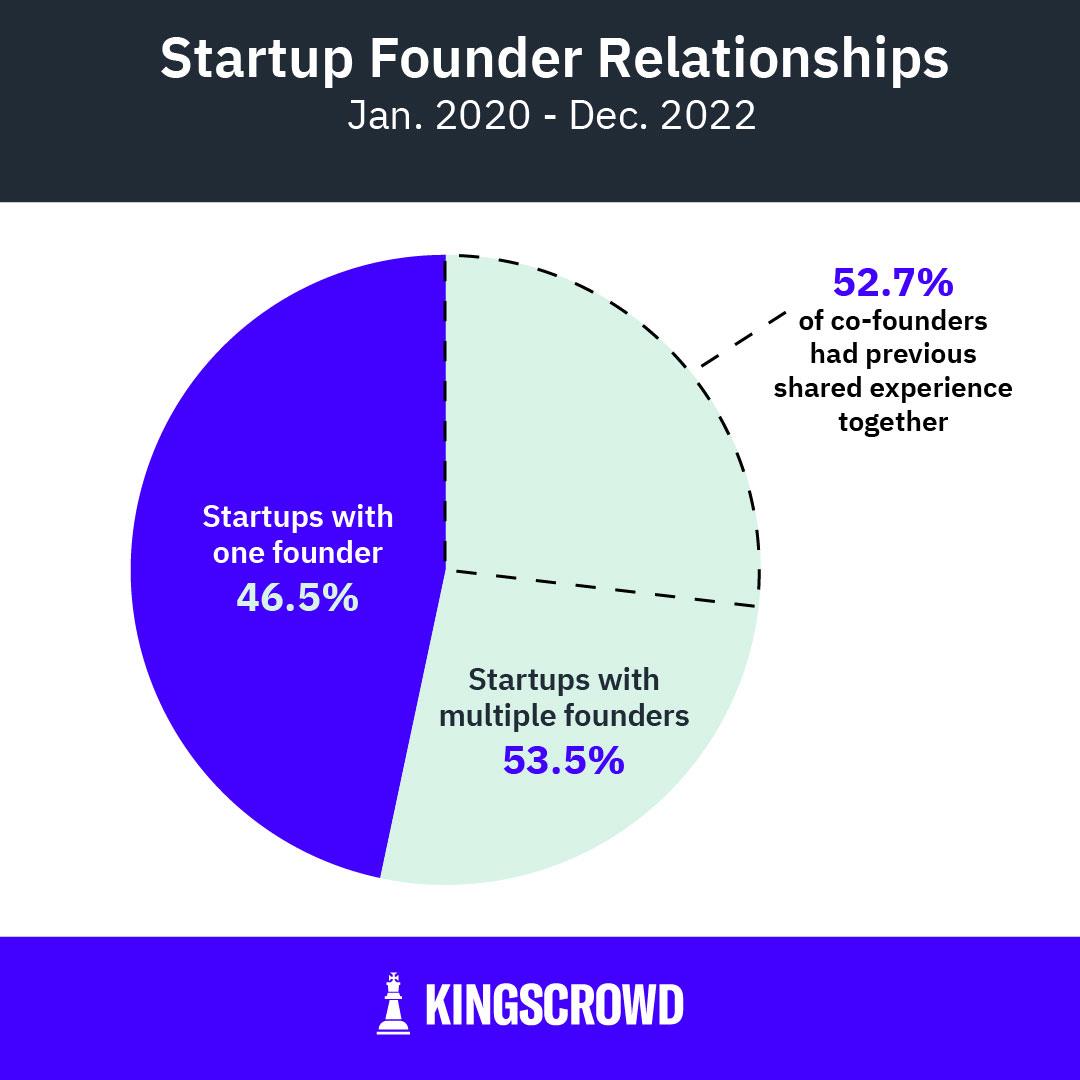

Who has a better chance at raising funds under investment crowdfunding - a company with a single founder or a company with co-founders?

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by ... more

Before answering the question, it's important to understand the current state of how many equity crowdfunding companies are run by solo founders vs. two or more founders. From a recent KingsCrowd Chart of the Week, we can see that roughly 47% of all equity crowdfunding raises since 2020 were run by solo founders, while the other 53% had two or more co-founders.

With that perspective, let's look at some thinking around whether or not single founders or co-founders are more successful at raising funds.

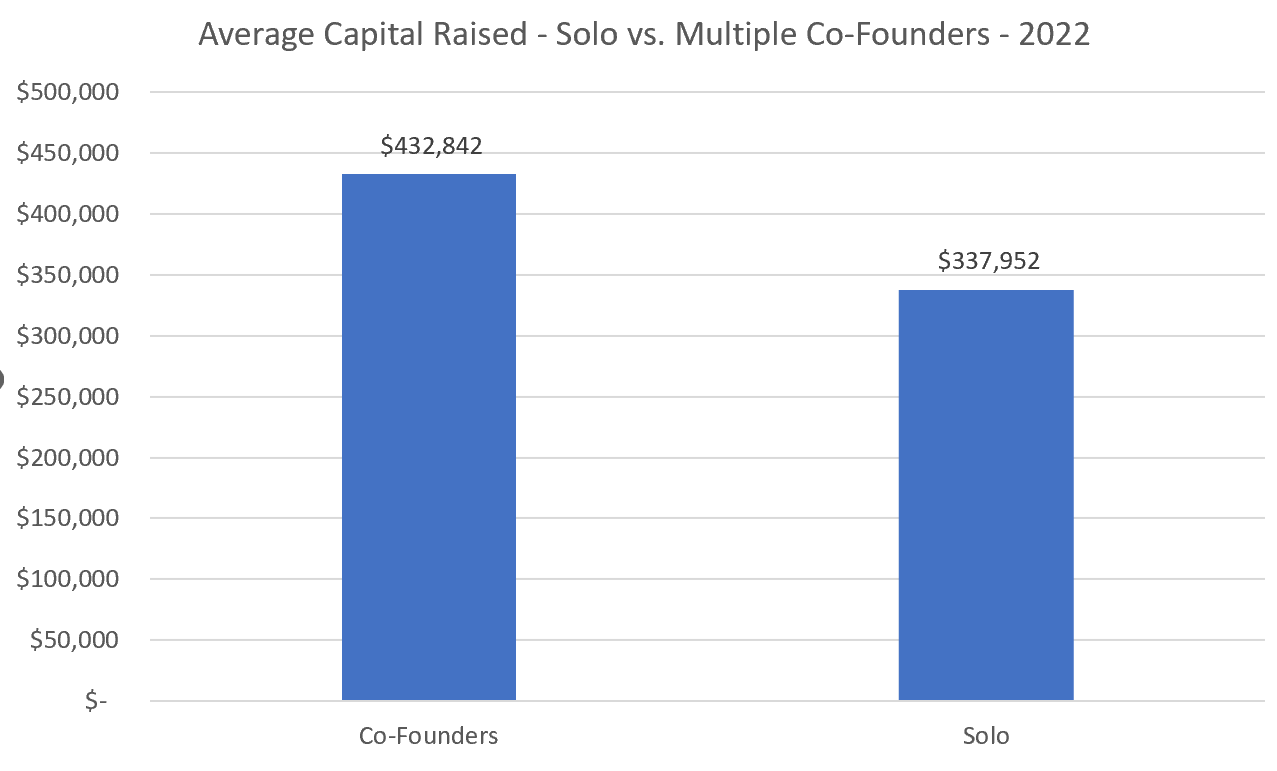

Looking at 2022 data from KingsCrowd for raises that closed in 2022, here are the average amounts raised for Reg CF campaigns (equity and debt crowdfunding):

The data shows that companies with 2 or more founders raised $433k on average, while companies with solo founders raised $338k on average. That being said, there have still been some very successful campaigns run by solo founders, so this is by no means a hard rule.

There could be reasons in the data that skewed a higher average towards companies with co-founders. For example, it could be that later-stage companies (those with revenue that tend to raise more money on average) may have been around for longer and potentially recruited additional founders to the founding team, vs. those founders who are just getting started out.

However, there could be other reasons that lead investors to invest more in companies with co-founders.

A company with co-founders may be a signal to investors that the product and mission are something that isn't just in the mind of a single individual, but something that has the potential to capture the passion of multiple founders. This could also indicate potential about one (or more) of the founders' abilities to sell the vision and the business potential to others.

Multiple founders may also be looked upon favorably by investors as a system of redundancy. Life happens and startups are hard, and it could be more reassuring to know that there are multiple founders on a team providing support to one another and encouraging each other to continue with the going gets tough.

Co-founders can also use their combined network of contacts to seek out and establish relationships with investors, which provides greater access to potential funding opportunities than if a single founder was pitching alone. Finally, many large investor groups prefer investing in companies with more than one founder because they feel it reduces risk by providing more oversight and management than an individual leader can provide on their own.

Therefore, while companies with single founders may have success in raising funds through investment crowdfunding platforms, co-founded companies may have a slight advantage when it comes to this form of fundraising.

less