- Home

- Q&A

-

Hi Mr. Huston, I am a law school graduate and interested in getting into crowdfunding. Any suggestions or recommendations? Thank you, Ray Hill

Hi Ray,

Congratulations on your graduation from law school. I always recommend to someone new to investment crowdfunding to start by visiting a platform looking around, finding a company you like, and investing in the company. Experiencing a crowdfunding campaign as an investor is a significant firs... more

Hi Ray,

Congratulations on your graduation from law school. I always recommend to someone new to investment crowdfunding to start by visiting a platform looking around, finding a company you like, and investing in the company. Experiencing a crowdfunding campaign as an investor is a significant first step. Going through the due diligence process reviewing the form C to get a better understanding of the required compliance and then experiencing the marketing and investor acquisition process reading campaign page updates, asking questions, reading the responses from the founders and reading your emails, attending founder webinars, and engaging the investor community with your questions and insights. This would be the first step in better understanding the process as an investor. I find the larger platforms do a great job of providing regulatory information for both investors and founders so digging into the FAQ section will provide some deep practical insights into the process. If you enjoy the process begin looking for your place in the industry connecting with the platforms and securities attorneys to learn that aspect of the business.

less4 -

How might regulated investment crowdfunding evolve in 2023?

It is difficult to predict exactly how regulated investment crowdfunding will evolve in 2023, as it depends on a variety of factors such as changes in the regulatory environment, technological developments, and market trends. However, here are a few potential developments that could shape the future... more

It is difficult to predict exactly how regulated investment crowdfunding will evolve in 2023, as it depends on a variety of factors such as changes in the regulatory environment, technological developments, and market trends. However, here are a few potential developments that could shape the future of regulated investment crowdfunding:

1. Increased use of blockchain technology: Blockchain technology could potentially be used to streamline the crowdfunding process, making it faster and more secure.

2. Development of new regulatory frameworks: Governments around the world may develop new regulatory frameworks to address the unique challenges and opportunities presented by crowdfunding.

3. Growing popularity of alternative forms of financing: Crowdfunding may become more popular as an alternative to traditional forms of financing, such as bank loans or venture capital.

4. Increased competition: As crowdfunding becomes more popular, more platforms may enter the market, leading to increased competition among platforms.

5. Greater focus on investor protection: As the industry evolves, there may be a greater focus on protecting the interests of investors, including through the use of measures such as disclosure requirements and investor education.

Overall, it is likely that regulated investment crowdfunding will continue to grow and evolve in the coming years, with a focus on using technology to improve the efficiency and effectiveness of the process.

*Written by OpenAI's ChatGPT*

less -

Where should I incorporate a benefit corporation?

@Brian Belley, @Jenny Kassan and @Sara Hanks, I wonder if you have thoughts about where to incorporate a benefit corp.

... more@Brian Belley, @Jenny Kassan and @Sara Hanks, I wonder if you have thoughts about where to incorporate a benefit corp.

less -

What is the average amount that issuers spend on investor acquisition (for a Reg CF deal?)

This is a great question! @Brian Belley recently told me that the average investment via Reg CF is about $750. That suggests there is some room to budget for marketing. On the other hand, investors plopping down $100 leave very little room. I hear ranges of from 10 to 30% for marketing budgets. Usin... more

This is a great question! @Brian Belley recently told me that the average investment via Reg CF is about $750. That suggests there is some room to budget for marketing. On the other hand, investors plopping down $100 leave very little room. I hear ranges of from 10 to 30% for marketing budgets. Using 20% against the average of $750 would suggest the cost of investor acquisition is $150--far more than a common $100 minimum investment. I hope Brian or others can add more color to this conversation.

less -

Hi Brian, Thanks for helping the community by answering questions. Based on your personal experience with 200+ startup investments, how do you pick a startup with the limited data available and without understanding other competitors? I know there is no crystal clear...

Thanks for the question. Quick disclaimer: this is just my own personal preference and experience, this is not to be construed as investment advice! Each investor has their own reasons and criteria when investing, so you need to determine what that looks like for you.

When personally picking a compa... more

Thanks for the question. Quick disclaimer: this is just my own personal preference and experience, this is not to be construed as investment advice! Each investor has their own reasons and criteria when investing, so you need to determine what that looks like for you.

When personally picking a company to invest in, for me, it comes down to two primary things:

1. Does it match my investment thesis (e.g. my "why" for investing - whether it's a company I am passionate about, a market I think will be huge, a technology that I believe could change the world), and

2. Due diligence - e.g. are there any red flags? Are the deal terms fair? etc.

For point one: I recommend investors reflect on the reasons they are investing and what they want to achieve. Are you only looking to maximize financial returns? Do you care about social impact? Are you trying to support local small businesses?

For point two: personally, I follow a "5 T's" approach to due diligence. Due diligence is a topic that could fill volumes by itself, but you can read more about due diligence in two articles I wrote and videos I made:

Due Diligence Part 1 - https://crowdwise.org/crowd-investing-101/due-diligence-101-overview-for-crowdfunding-investors-part-1/

Due Diligence Part 2 - https://crowdwise.org/crowd-investing-101/due-diligence-101-part-2-the-1-reason-why-startups-fail-and-how-to-screen-deals/

There are also services out there that will aggregate and review deals to help investors scale their due diligence, such as KingsCrowd (disclaimer: I am currently VP of Product at KingsCrowd).

And ultimately, you should always go to the campaign page and read all the details, including all deal terms. Another gem of information on these pages are the investor Q&A sections. You can not only post your own questions to be answered by the founder, but you can read other insightful questions from potential investors of all backgrounds.

I always read the Q&A. You can learn a lot about the company and how they communicate and handle tough questions.

Happy investing!

less3 -

Hi Sara, you come recommended as a real expert in this field. I have a question that I'm hoping you can answer. During the Testing The Waters phase, is it possible to solicit feedback from a pool of potential investors on deal terms that would appeal to them in order to determin

Thanks!

Yes, you can solicit as to what terms people might find attractive, including valuation. I would generally include a disclaimer of some kind saying that just because something has been suggested it doesn't mean that will be reflected in the deal terms if you eventually make an offering.

&nbs... more

Thanks!

Yes, you can solicit as to what terms people might find attractive, including valuation. I would generally include a disclaimer of some kind saying that just because something has been suggested it doesn't mean that will be reflected in the deal terms if you eventually make an offering.

Sara

less2 -

Crowd funding is awesome for retail investors! One challenge I would see with crowdfunding are following. How do we mitigate these? - Start up founders are more and more getting greedy with valuations with no product/proof of concept in hand. A lot of tooling is needed to provid

Both valid comments, there are a few quick answers to make the severity of these problems perhaps less worrisome:

1) the average investment in a successful crowdfunding campaign is only $96. So, the real risk vis a vis the founder's self-proclaimed valuation is not only mitigated by this avera... more

Both valid comments, there are a few quick answers to make the severity of these problems perhaps less worrisome:

1) the average investment in a successful crowdfunding campaign is only $96. So, the real risk vis a vis the founder's self-proclaimed valuation is not only mitigated by this average, but there are also caps on how much a retail investor can invest annually in crowdfunding. For instance, anyone earning under $107,000 annually, can only commit $2200 or so. 5% of their annual income. I'd say there are far more dangerous "investments" people make with far more predictably bad outcomes (hamburgers?).

2) as to how to know if other, potentially better, candidates for your money are making similar solutions available to investors, that's always hard to say, but I'd say you might reconcile "Caveat Emptor" dictates responsibility in both of these questions: "the principle that the buyer alone is responsible for checking the quality and suitability of goods before a purchase is made."

So, do your homework. I mean, you' wouldn't buy a house sight-unseen without looking over the neighborhood, checking out the schools, etc.

Great questions. Keep em comin'

less -

Hi, I have been investing through seedinvest, wefunder and republic etc. i can check my portfolio in their websites. - Is there any way i can request physical copies to prove the ownership? Or in other words, who is the guarantor for shares as i heard there can be an escro

Hi - You should contact the applicable funding portal with your request. You can find their contact information on the site and in their terms of service.

0 -

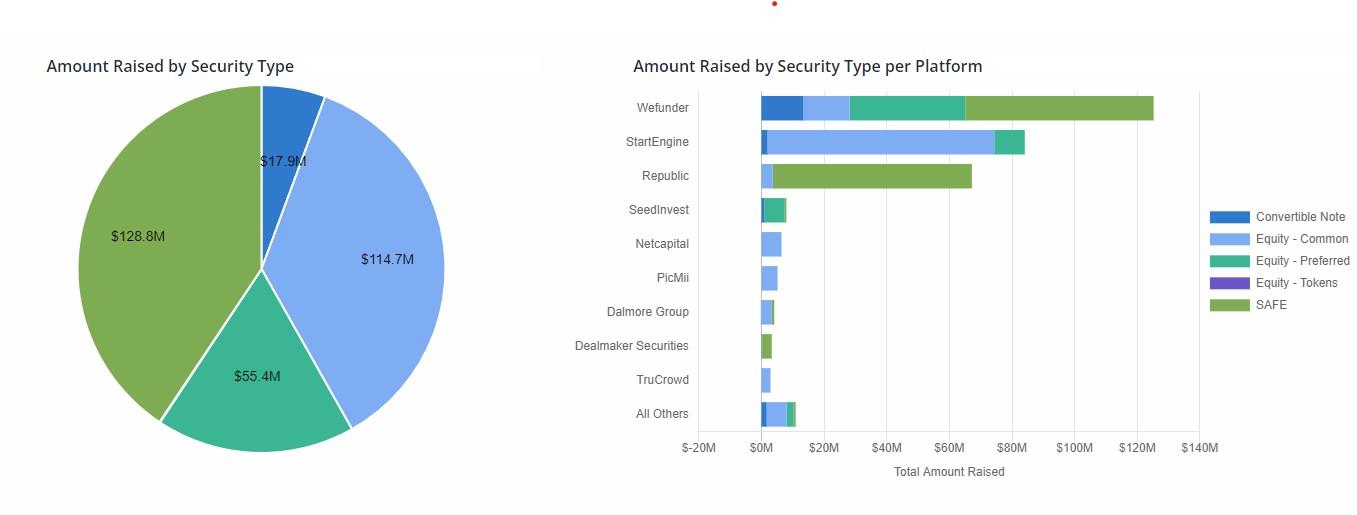

What are the type of securities used on the top Reg CF platforms?

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. E... more

Here is a breakdown from KingsCrowd for the most popular security types for Regulation Crowdfunding (Reg CF) in 2022 so far:

As the figures show, the most popular security types in Reg CF in 2022 are:

1. SAFE (Simple Agreement for Future Equity) - $128.8M, 41%

2. Equity (Common) - $114.7M, 36%

3. Equity (Preferred) - $55.4M, 17%

4. Convertible Note - $17.9M, 6%

One can see that the type of security offered also various by platform, as platforms tend to prefer (or avoid) certain financial instruments.

For example, SAFEs are the most popular on Republic and Wefunder, while StartEngine is primarily Equity (Common).

For more details on security types in equity crowdfunding deals and their differences, check out the article I wrote here:

https://crowdwise.org/crowd-investing-101/part-4-deal-types-equity-crowdfunding/

less -

Are there any helpful crowdfunding events coming soon?

Glad to learn of your interest in regulated investment crowdfunding (#RIC).

Yes, there are a few upcoming events in the space ...

SuperCrowd22 will include a Who's Who in regulated crowdfunding and will examine the intersection of crowdfunding and impact investing. It is a web-based event bein... more

Glad to learn of your interest in regulated investment crowdfunding (#RIC).

Yes, there are a few upcoming events in the space ...

SuperCrowd22 will include a Who's Who in regulated crowdfunding and will examine the intersection of crowdfunding and impact investing. It is a web-based event being co-hosted by the Crowdfunding Professional Association (CfPA), Brainsy, and many other impactful organizations September 15-16 (registration link is here: https://www.supercrowd22.com/httpssupercrowd22comtextandpercent20otherpercent20experts-register-joinpercent20thepercent20supercrowd ) For more info, follow up with Devin Thorpe

Equity Crowdfunding Week is another event that takes place a week later in person in LA (September 21-23) or online - https://www.startupstarter.co/ecw For more info, follow up with Etan Butler

Silicon Prairie Crowdfunding often hosts webinars on Wednesdays on various topics related to crowdfunding (for beginners to experienced hands) and you can see a list of their events at: https://www.meetup.com/silicon-prairie-fundraising For more info, follow up with David Duccini

Stay tuned on the CfPA ECO as CfPA often hosts events or promotes the events of members organizations.

less